What is a Post-Only Order?

A Post-only order is an advanced option for Limit Orders. Under the option, users be a maker. If you choose the option “Post Only”, a limit order placed by a user will never match with any orders already on the book. If any part of the order would execute immediately, the entire order will be rejected by the system.

The advantages of a Post-Only Order

By selecting the post-only option with your Limit Orders, traders can ensure that their Limit Orders will never be executed immediately (or be a taker) and they will always provide liquidity to the market as a maker, and therefore receive a maker rebate when the order is executed.

For example, in a highly volatile market situation, the BTC price has fallen to 10,005 USDT. You wish to buy 10 BTC at 10,000 USDT. When you place a limit order, the market continues to decline and the BTC price is moving towards a fresh low of 9,995 USDT.

Without Post-Only option:

If you don’t select the post-only option, when the BTC price hits 9,995 USDT, the limit order you placed for 10 BTC at 10,000 USDT will be immediately executed with the order on the book as a Taker Oder. As a result, this may unintentionally cause you to pay a taker fee (higher than a maker fee). Additionally, you cannot buy BTC at a more favorable price.

With Post-Only option:

With the Post-Only option, when the BTC price hits 9,995 USDT, the system will automatically cancel the limit order you placed for 10 BTC at 10,000 USDT, if it detects that it will result in immediate order execution. This means that you don’t have to pay any unintended taker fees for the order, while you can still adjust your strategies to buy BTC at a better price.

In sum, as to the quantitative trading institutions or market makers with specific strategies, the post-only option ensures that they can always be a trader providing liquidity, helping saving a great amount of transaction fees. It has outstanding trading advantages over other trading strategies. For scalp traders, the post-only option allows traders to readjust their trading strategies while avoiding extra trading fees over immediate order execution in a highly volatile market, thus earning greater profits.

Post-Only Option Setting

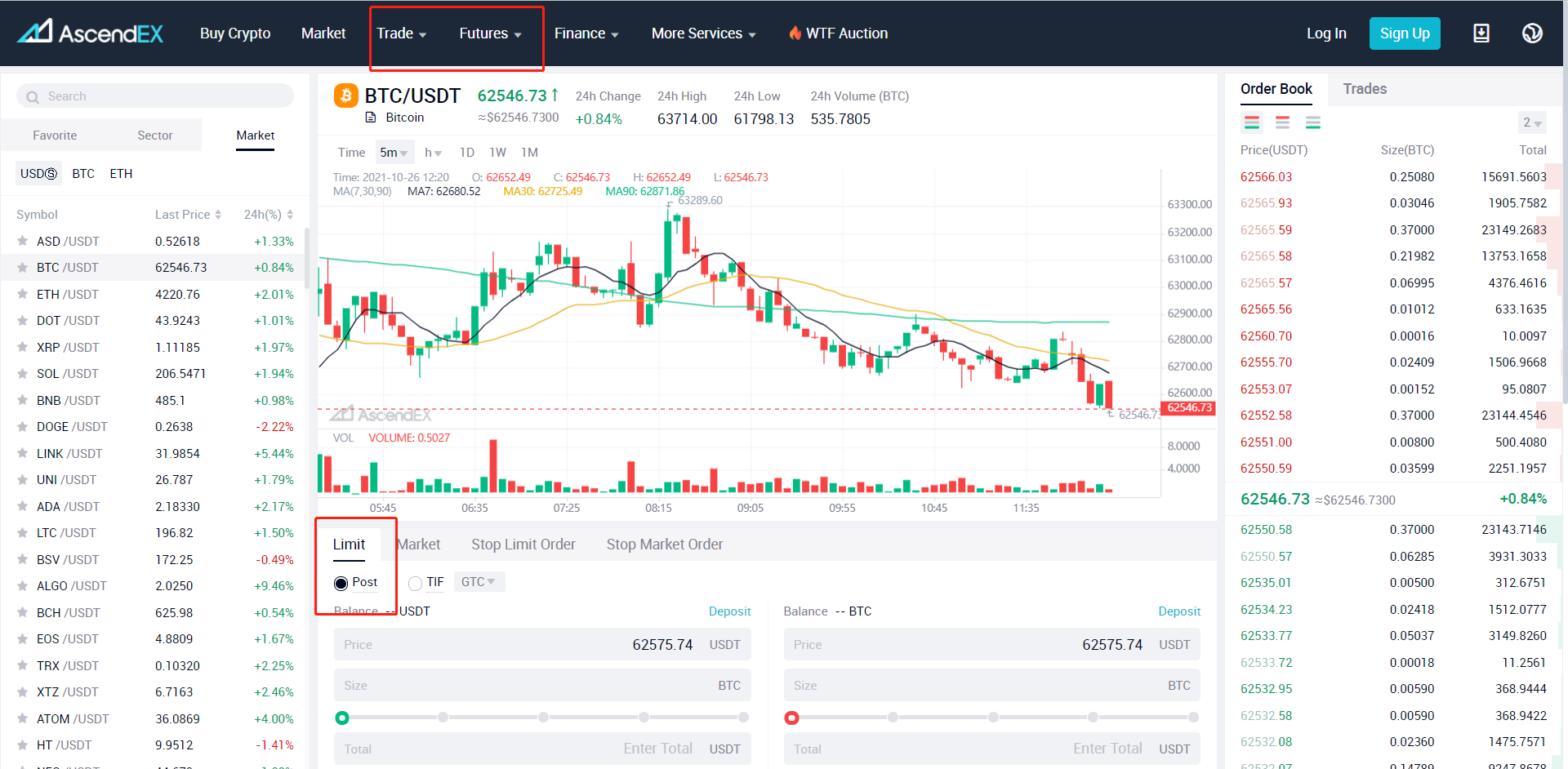

PC Clients: Cash/margin/futures trading details pages