HELP CENTER

How to Check the Maximum Borrowable Limit for a Token【APP】

Publish on 2021-12-14

What’s the Maximum Borrowable Limit?

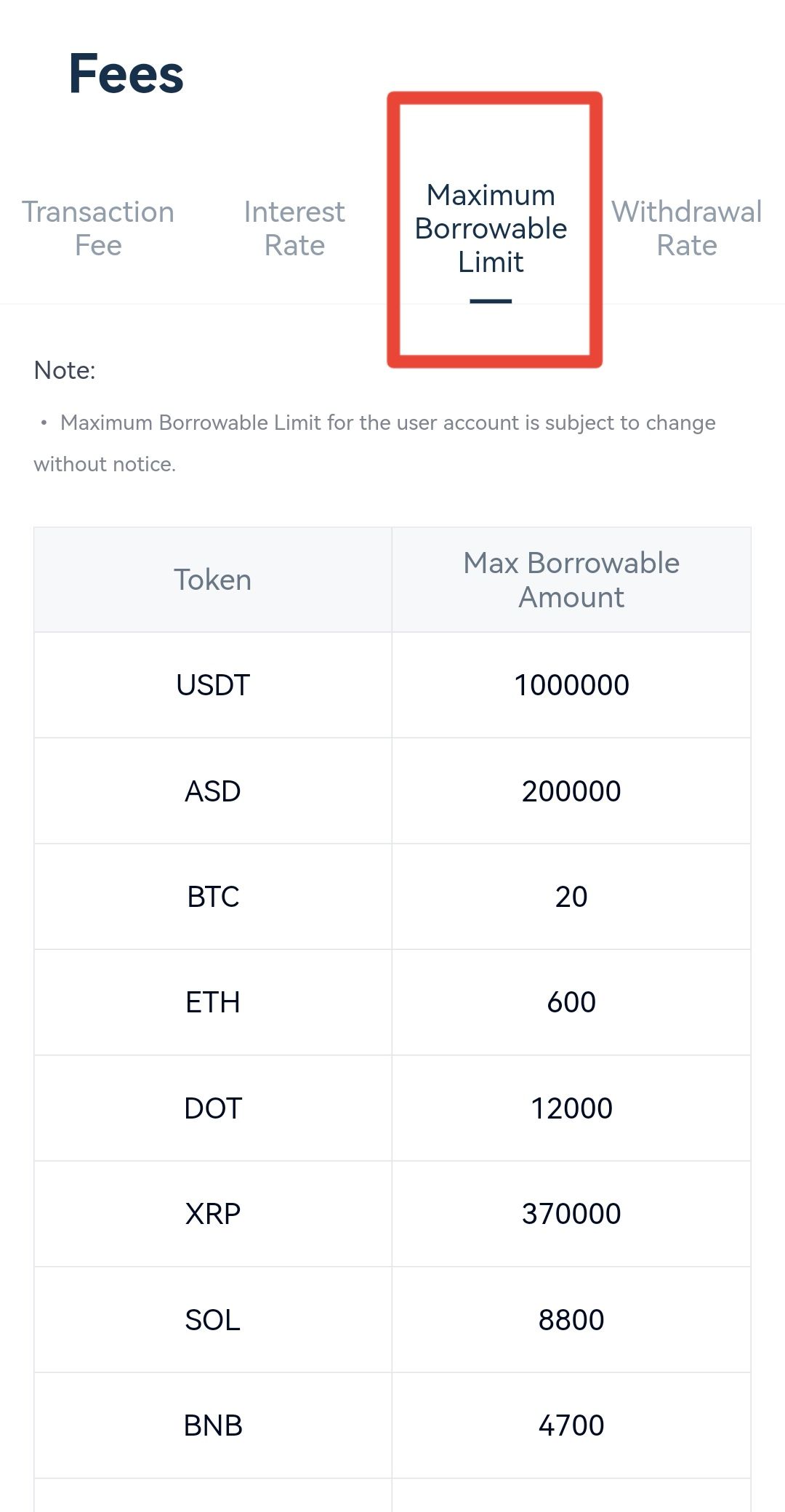

The maximum borrowable limit refers to the maximum amount of a token that users are allowed to borrow while margin trading. Take USDT as an example, if the maximum borrowable limit for the token is 1,000,000 USDT, the borrowing amount for a margin account is capped at 1,000,000 USDT.

However, please note that the maximum borrowable limit for the user account is subject to change. In addition, the whole process of trading is also subject to multiple factors such as the leverage of a token, the investments of users and the overall loan conditions of a platform. Therefore, users’ maximum borrowable limit might be different from what they expect. For instance, if the order a user placed is rejected because the total loan exceeds the maximum borrowable limit of their account, it means the amount of the token being borrowed has hit the maximum borrowable limit set by the platform and the user will need to repay and reduce the outstanding loans before borrowing again. Users should navigate to the Maximum Borrowable Limit page or follow the steps shown below to check the maximum borrowable limit for each token before margin trading.

How to check?

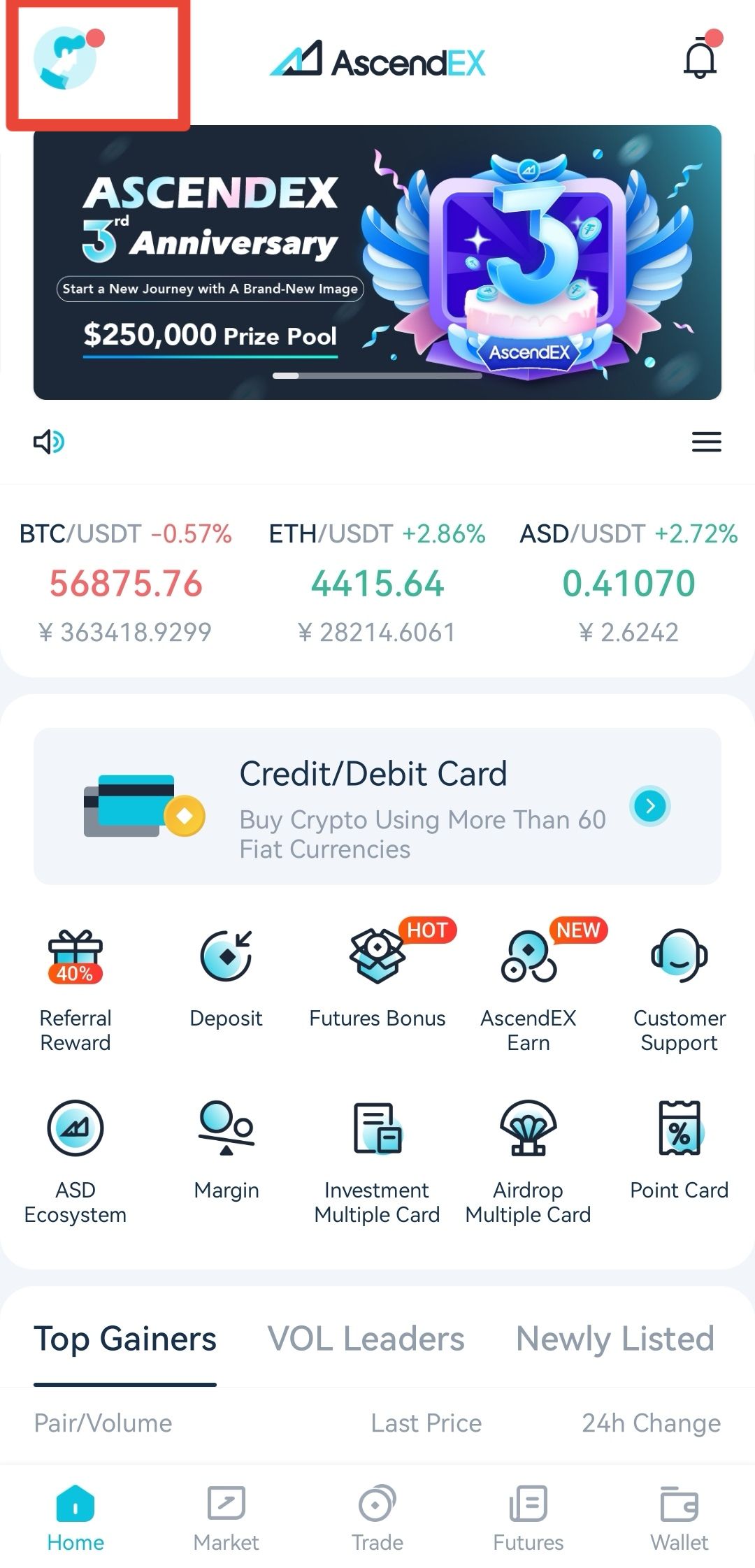

1) Open the AscendEX App and click on the profile icon in the upper left corner of the homepage.

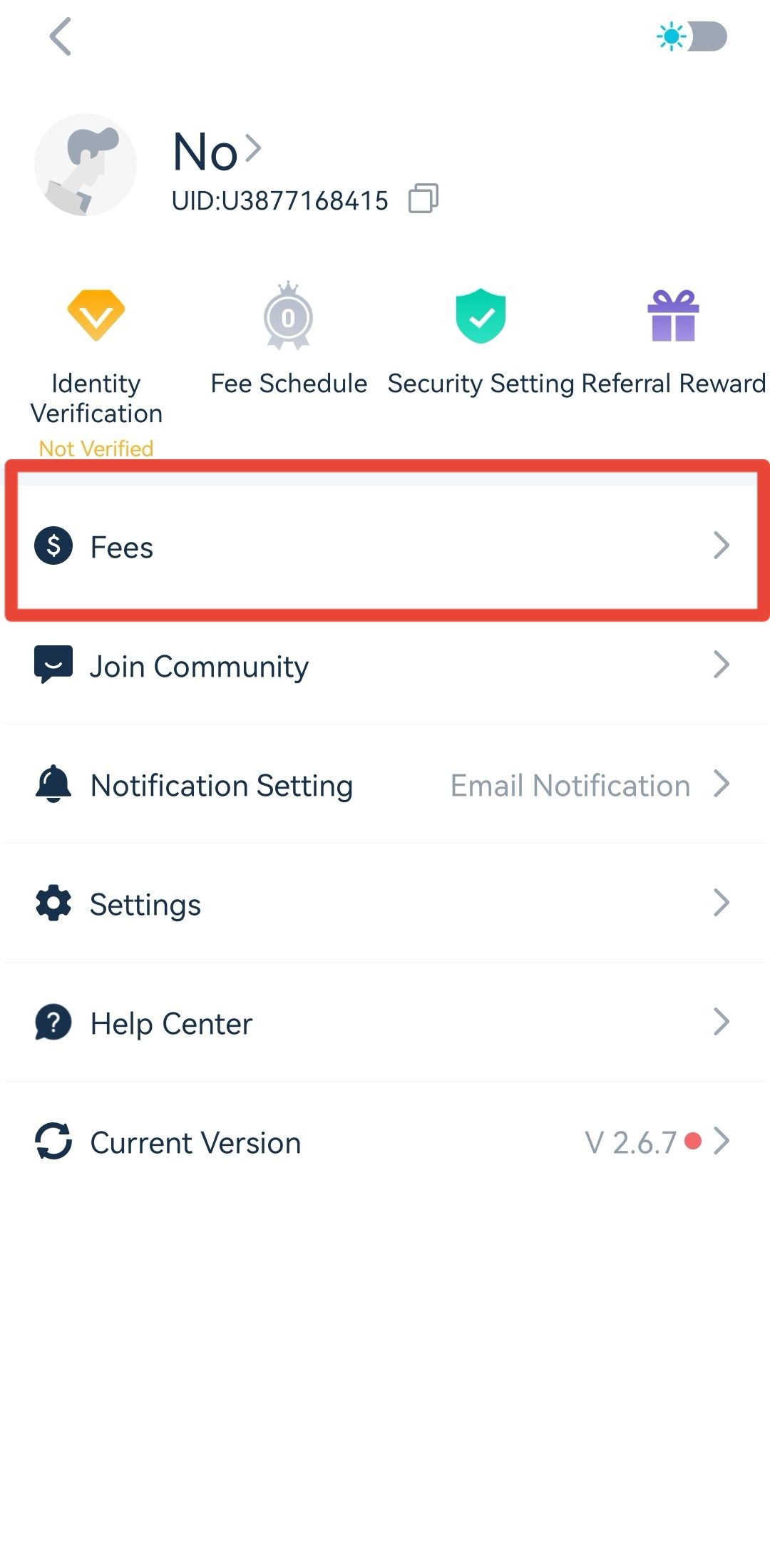

2) Press “My Account” button and click “Fee Rates”

3) On the Fee Rate page, click on “Maximum Borrowable Limit” to check the maximum borrowable limit the platform sets for each token for margin trading.