As 2021 is coming to an end, AscendEX wanted to take an opportunity to reflect on the past year of exciting progress, adoption, and evolution in the crypto markets. As a centralized crypto platform acting as a bridge between CeFi and DeFi, we exist at the nexus between retail, institutions, and DeFi protocols, putting us in the position to have unique insights into market conditions and trends. Having this unique point of view, we wanted to point out and share our insights into a number of key trends we have been closely monitoring, and highlight some of the exciting developments at AscendEX over the past year.

Market Highlights

Over the past year the crypto markets have “crossed the rubicon”, and while it is still very much a place for innovators and early adopters, in many ways it has broken into the mainstream, with a widespread understanding that this emerging asset class is very much here to stay. “It was inevitable …” — this seems to be the common thread among crypto market participants reflecting on what has been a meteoric uprise of institutional adoption, increased maturity around emerging layer-one (L1) networks, and integrations with metaverse applications.

Institutional Adoption

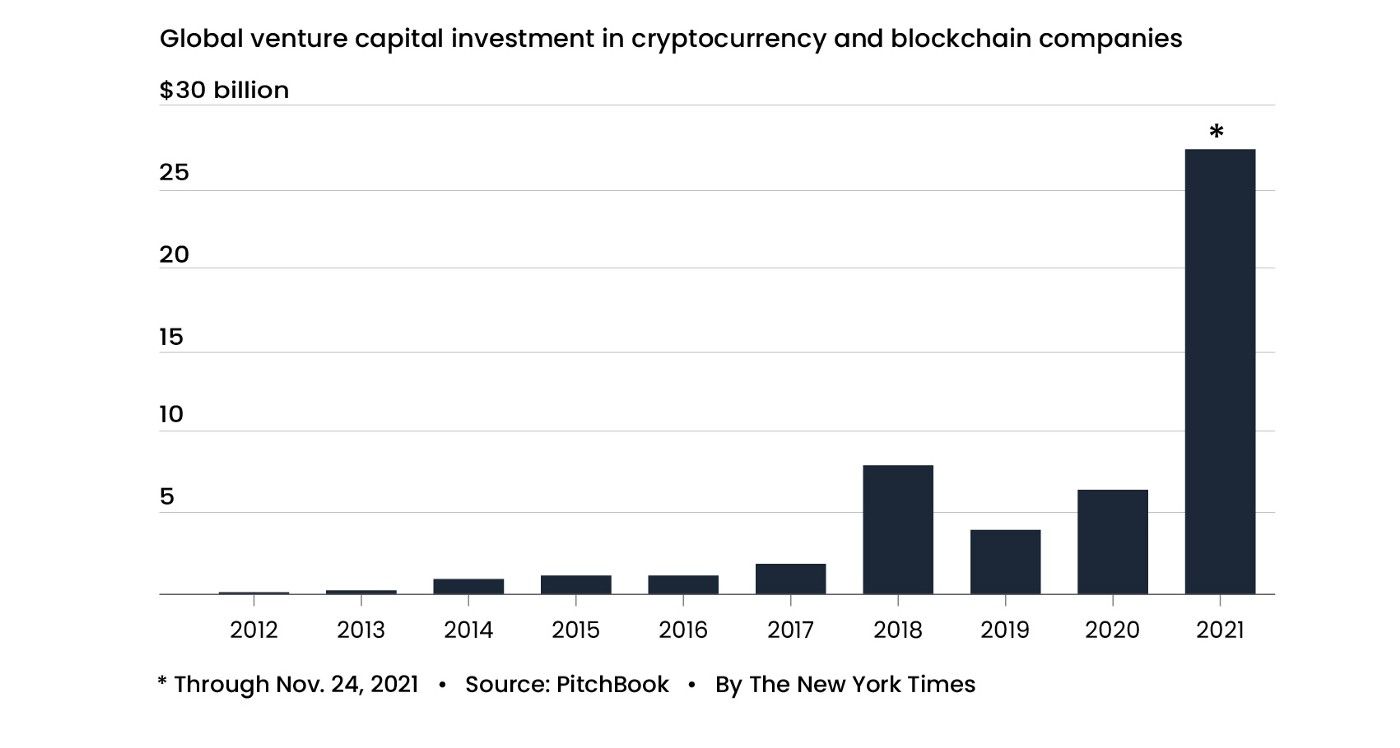

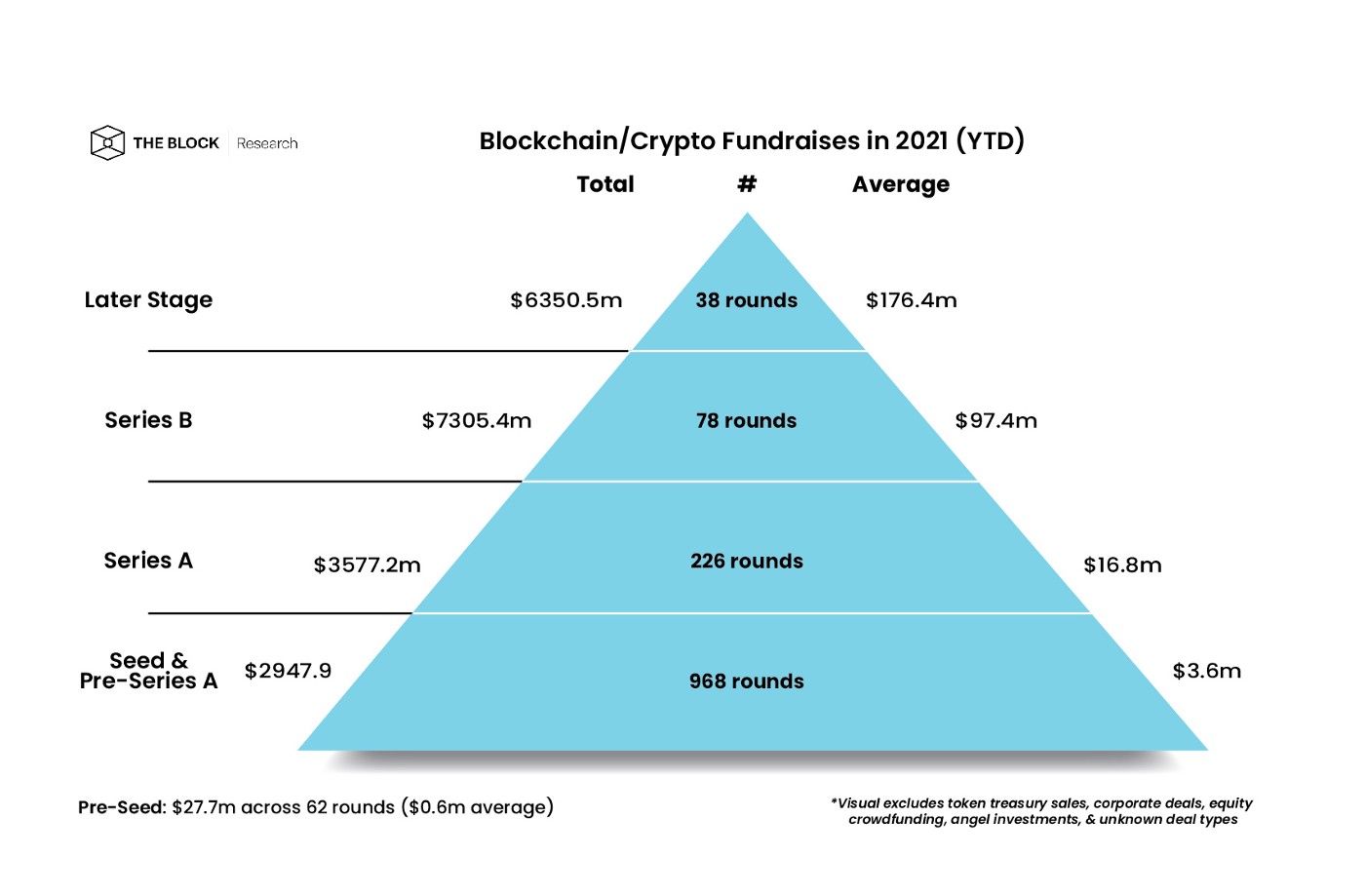

With this widespread understanding has come the wave of institutional adoption. Traditional capital markets participants have been buying blue-chip crypto assets, which have clearly become both part of macro and technology investment portfolios. Similarly, the trend of public crypto investment vehicles including ETPs and corporations adding bitcoin to their balance sheets has continued to accelerate. In the private markets, Venture Capital investors have raised and deployed enormous sums of money, with a record amount of VC money coming into the space; in Q3 2021 alone, venture capitalists invested an estimated $8.5B in crypto startups, the largest quarterly sum ever. Many VCs now have multiple billions of dollars of crypto in AUM, a trend that has only accelerated in Q4, with the number of crypto unicorns surging to more than 60 this year, covering exchanges, infrastructure firms, gaming companies, and more. While VCs have followed developer talent with their investment capital, talent has done the same, resulting in a reflexive loop and a broad influx of talent that has benefited the industry.

Entering a Multichain world

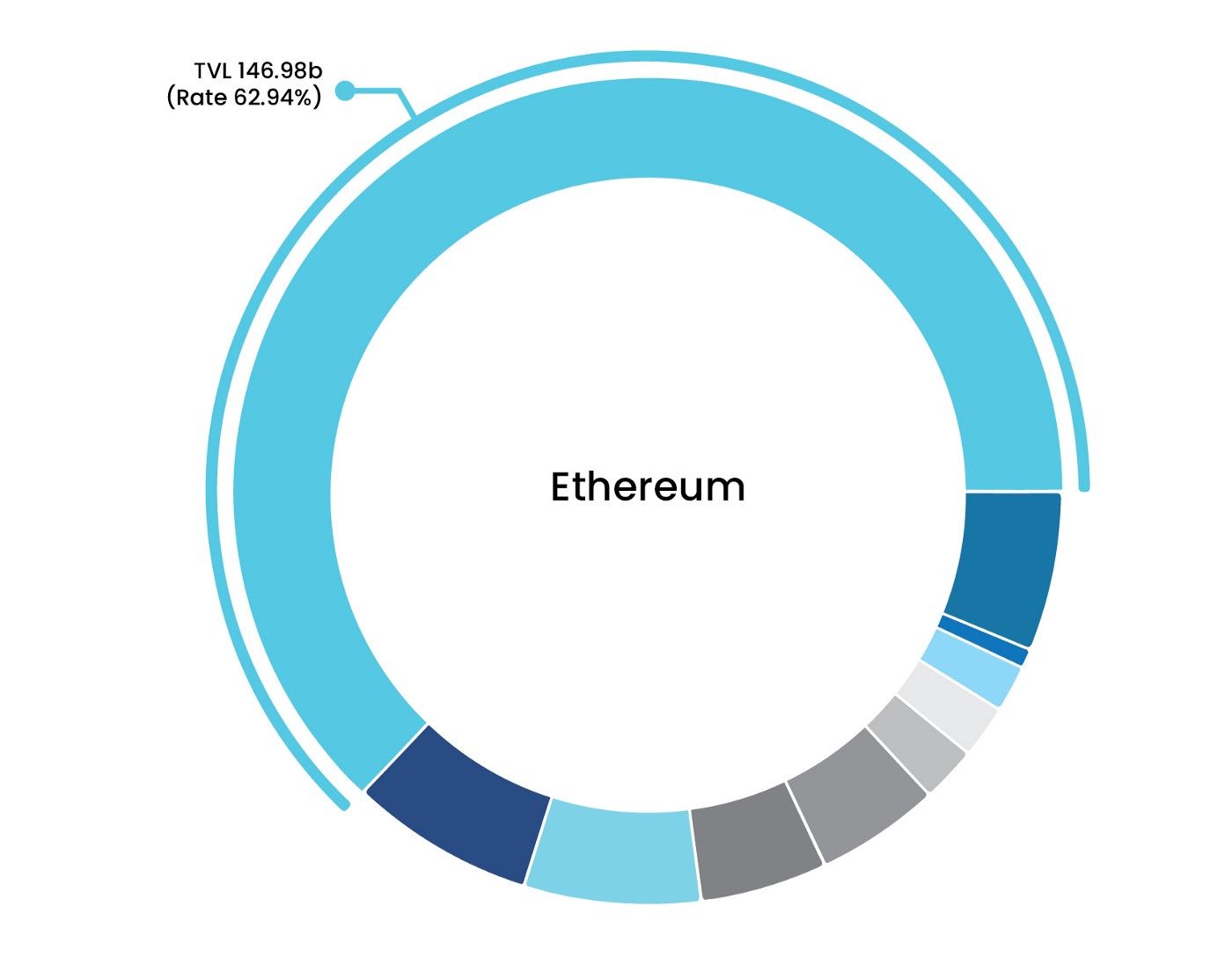

Following DeFi summer in 2020, there was an explosion of innovation and excitement around DeFi, which primarily took place on Ethereum. Just one year ago, Ethereum represented upwards of 97% of all Total Locked Value (TVL) in crypto. In a short time, nascent protocols have matured dramatically, and it has become clear that the crypto ecosystem will be inhabited by multiple interoperable blockchains. Today Ethereum TVL dominance sits at ~65%, and while still the majority, the landscape is vastly different and increasingly fragmented, with many alternate EVM, as well as non-EVM compatible blockchains, increasing their aggregate market share. As the shortage of blockspace on Ethereum manifested itself in high gas fees, and L2 roll-ups were being developed, the increased demand for blockspace resulted in the massive appreciation of alternative L1s, as investors, users, and developers have come to understand that multichain is here to stay. Despite this, there remains a lack of infrastructure and interoperability solutions, and much progress is to be made on this front in order to prevent the fragmentation of these various ecosystems. Positioned as a chain agnostic organization, AscendEX has continued to support many different L1s and ecosystems as this multichain world plays out in real-time.

(Link to graphic — https://defillama.com/chains, labels/keys can be found dynamically on the website)

The Liquidity Wars

While interoperability will help integrate the multichain world into something that works more seamlessly, the fact remains that various L1s and dApps are still fundamentally competing for the attention and assets of users, developers and investors, and while a rising tide lifts all boats, not all competition is necessarily positive-sum. As these competitive dynamics have started to play out, liquidity has remained the hottest commodity for protocols, with each of them offering larger and more unique incentives to attract assets. However, given the mercenary tendencies of DeFi liquidity providers, TVL has been a very poor benchmark to comparatively value a protocol. To illustrate, a primary driver of the shifts in TVL across different L1’s can be attributed to the dozen (or more) “ecosystem funds” launched by developer foundations such as Polygon, BSC, Avalanche, Harmony, Fantom, among others. Numerous times over, this has transpired in the following way: A L1 or L2 network bootstraps capital and launches an “Ecosystem Fund” that’s used to fund developers with grants to build applications on their chain and subsidizes rewards for users who provide liquidity to the native protocol. Most ecosystem funds do both to combat the “chicken and the egg” problem — the supply grants to builders and rewards to users. Protocols that implemented liquidity mining programs to bootstrap liquidity are learning that financial incentives alone are not enough to bridge the gap between speculator and user. Exodus of mercenary capital (outflows in TVL) following the conclusion of liquidity mining programs have led to new innovations in the art of attracting liquidity, including protocol owned liquidity, discussed in more below (“DeFi 2.0”).

While total value locked has become a popular metric for standardizing a DeFi protocol’s usage compared to the broader ecosystem, this approach has some flaws and limitations. TVL is merely the aggregate dollar value of the collateral that’s deposited to a given network (Ethereum, BSC, etc.) or application (Curve, Aave, etc.). Because collateral assets are dynamic from one protocol to another, DeFi native money markets often “double count” liquidity. Take the example below that was described by CoinMetrics:

- A user deposits $1,500 worth of Wrapped Ether (WETH) into Maker to get a loan in the form of $1,000 worth of DAI (150% collateralization ratio).

- The user then deposits this newly minted DAI, as well as another $1,000 worth of USDC in the Uniswap V2 USDC-DAI pool. In return, the user gets Liquidity Provider (LP) tokens representing that $2,000 stake of that pool’s liquidity.

- The user can then redeposit these LP tokens into Maker to get another loan of $1,960 of DAI (102% collateralization ratio)

- Source: https://coinmetrics.substack.com/p/coin-metrics-state-of-the-network-0c0

Put simply, the flexible nature of most DeFi applications enables assets to be easily rehypothecated and double-counted as TVL in multiple protocols. Though used as a benchmark to compare protocols at a specific point in time, the ease of withdrawing rented liquidity, and the sheer velocity of TVL in DeFi in the face of decreasing yields has proven that this certainly does not capture the entire picture with regard to liquidity on protocols.

DeFi 2.0

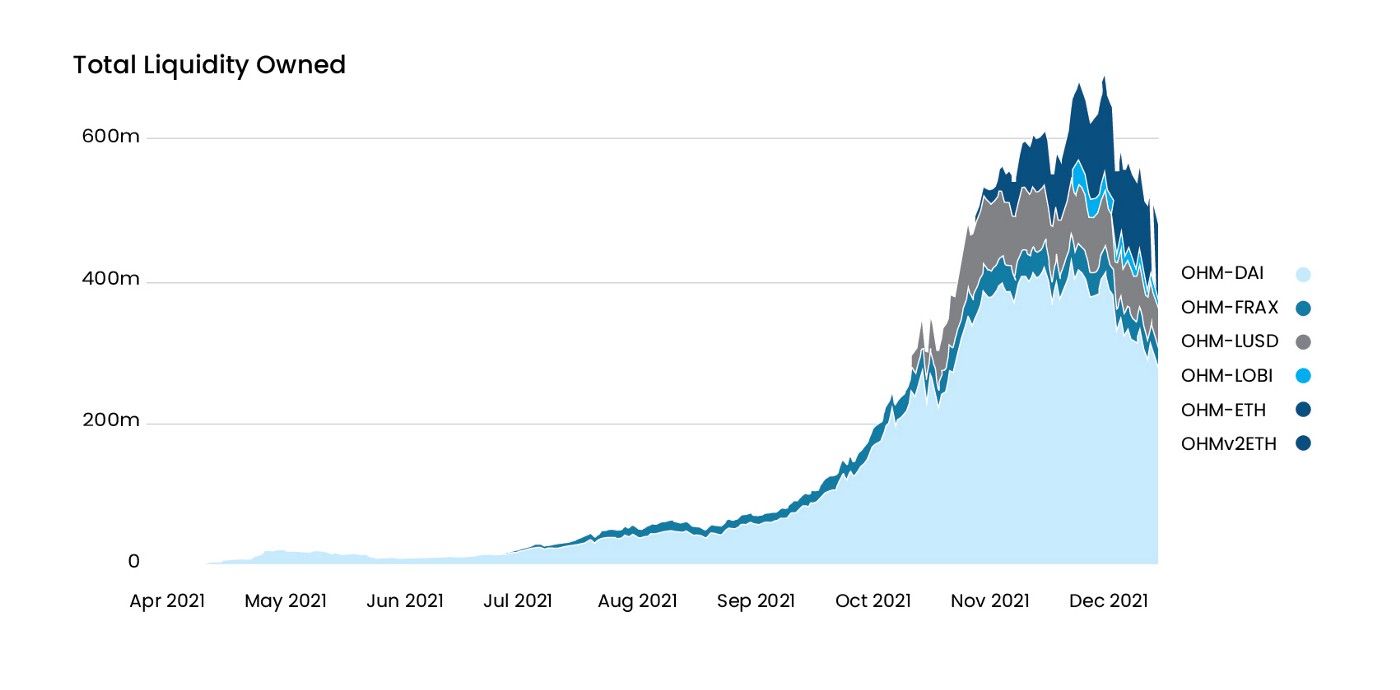

Over the last quarter of the year, we’ve seen flat TVL growth across many of the blue chip DeFi 1.0 dApps, such as MakerDAO, Curve, AAVE, Compound, and more. Though we do not expect them to go away any time soon, we are anticipating the next wave of growth to come from newer, more innovative DeFi protocols that have emerged over the past year — so called “DeFi 2.0.” Leading this new wave of DeFi protocol have been innovations in Protocol controlled liquidity. Pioneered by Fei Protocol, Protocol Controlled Value (PCV) has enabled the protocol, rather than individual liquidity providers to own the assets locked within a protocol. Instead of collateralizing assets for loans, or renting assets out for yield, PCV has instead enabled the sale of assets to the protocols itself. Over the past year, Olympus DAO has emerged at the forefront of this innovation, incentivizing users to bond their assets to the protocol in exchange of OHM, an unpegged collateralized reserve currency. As Ohm has arguably become the most forked DeFi protocol to date, we are keeping a close eye on this space and more importantly, we are excited for the prospect of Bonded Liquidity spreading to new and existing crypto projects, as they seek to mitigate the downsides of mercenary liquidity.

(Link: https://dune.xyz/queries/153224/303068)

Other Developments

In addition to the above headline themes of 2021, there have been a number of significant developments that we at AscendEX have been watching quite closely. While each deserve their own independent depth review, we wanted to briefly highlight a number of important trends

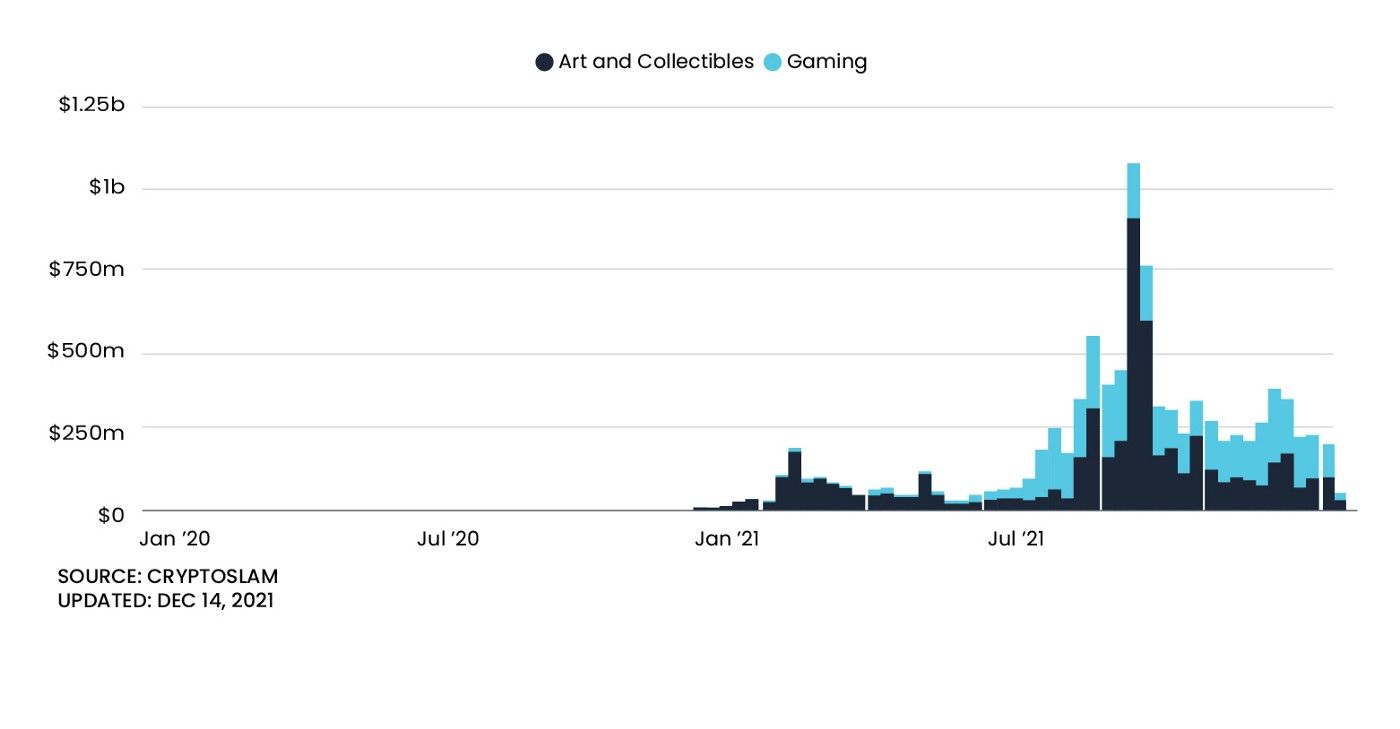

Non Fungible Tokens — While the first NFT token standard, ERC-721, was created in 2018, over the past year NFTs have been widely seen as the major disruptor with regard to digital ownership, starting with JPEGs and profile pictures, and quickly growing to include a much wider array of applications. Despite the infancy of current NFT infrastructure, they have managed to permeate mainstream culture to such a degree that it is clear they are here to stay, with the recognition that they will be a large part of the value creation within the crypto economy.

Play to Earn/Metaverse — P2E games like Axie Infinity found extraordinary product-market fit, and have amassed millions of users, enabling them to earn as they play. Taking advantage of these opportunities, gaming guilds such as Yield Guild Games have emerged, aggregating talent and sharing rewards. While crypto native P2E games have been innovating from an economic incentive standpoint, this is likely the beginning of an exciting trend where non-crypto native gaming companies will start building on and integrating crypto primitives into their games.

Web 3.0 — Over the past year, crypto has arguably undergone one of the greatest rebrandings of all time, becoming just one aspect of the larger Web 3.0 narrative, which represents the next iteration in the evolution of the internet, built on the notions of decentralization, permissionless, owned by users and builders, orchestrated with tokens.

Major Protocol Upgrades:

This year, we saw two major upgrades to both Bitcoin and Ethereum, Taproot and The London Hard Fork, which both mark significant milestones.

Taproot, Bitcoin’s latest upgrade, is its most significant one in four years, which enables the batching of multiple signatures and transactions together, making it easier and faster to verify transactions on Bitcoin’s network. The upgrade also scrambles transactions with single and multiple signatures together, making it more difficult to identify transaction inputs on Bitcoin’s blockchain[1].

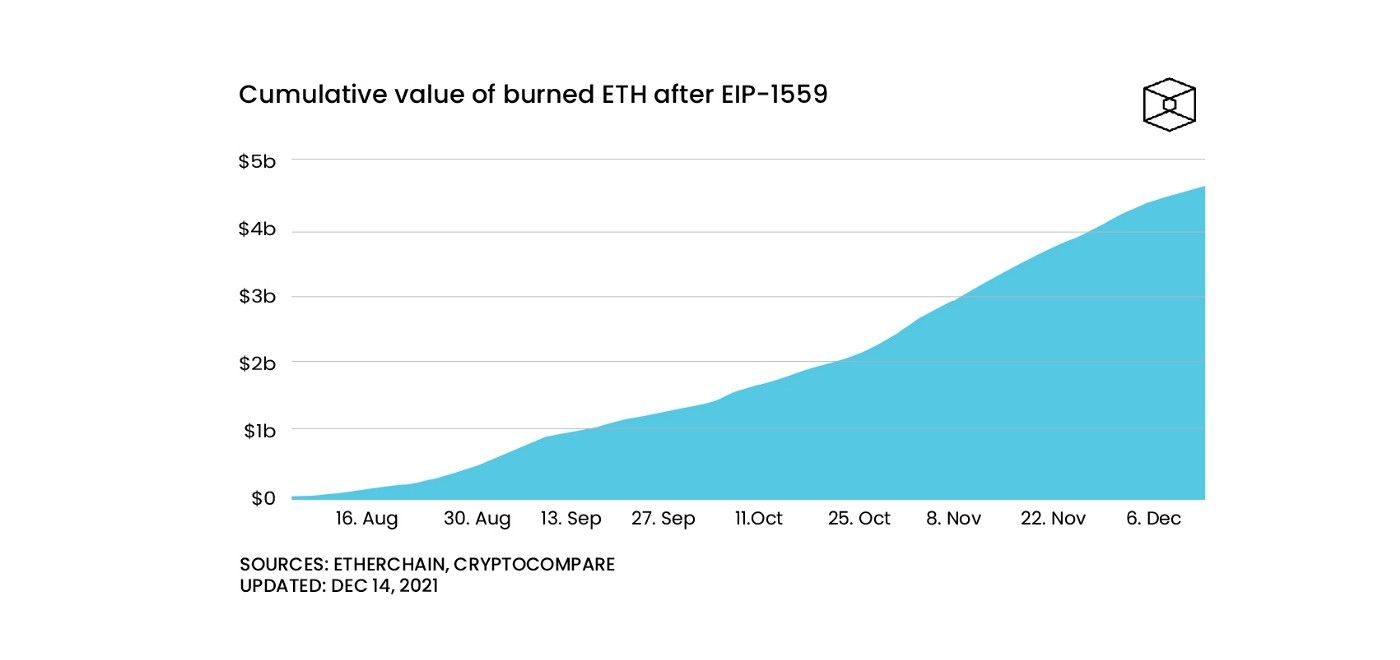

The London Hard Fork, was an upgrade to the Ethereum blockchain that included a set of five Ethereum improvement proposals (EIPs), including EIP 1559, which has made transactions more efficient by using a hybrid system of algorithmically determined base fees and optional tips to more evenly incentivize miners in periods of high and low network congestion. Additionally, a part of every transaction fee is burned, which has introduced a deflationary mechanism into Ethereum’s economics.

Despite the sheer size, value, and decentralization of both the Bitcoin and Ethereum networks, they have shown to have resiliency, while also still maintaining the ability to improve and update as the wider ecosystem continues to innovate at a rapid pace.

Scaling Solutions

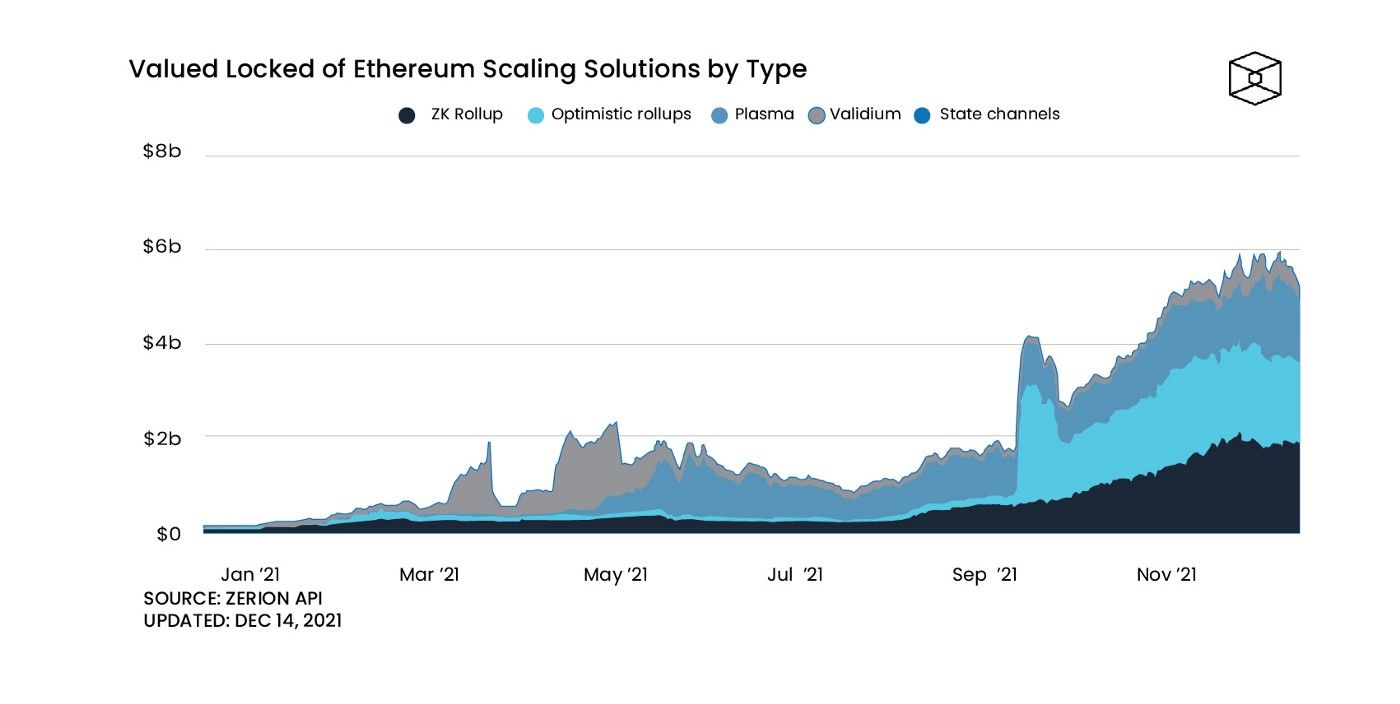

In addition to the above protocol upgrades, scaling solutions to help mitigate the drawbacks of conducting all aspects of transactions on-chain have become a key theme of 2021. The Lightning Network, one of the preferred Bitcoin scaling solutions that uses state channels to enable transactions to occur off chain, started to go exponential in 2021. While mainnnet launched in 2018, 2021 has been the year of record adoption, channel count, and network capacity. On Ethereum, a number of scaling solutions have gone live, including those using optimistic rollups, zero-knowledge rollups, validium, and plasma technologies, and have attracted billions of dollars in TVL. While Arbitrum, an optimistic rollup based L2 has maintained the top spot, with over $2.5B in TVL and 41% of market share, increasingly, ZK scaling solutions are coming on the scene. Today, of the top 10 scaling solutions ranked by TVL, 4 use zk technology, 4 use optimistic roll ups, and 2 use validium. Increasingly, we are expecting more and more decentralized as well as centralized participants in the crypto ecosystem to onboard and start using these various scaling solutions as they continue to mature. Even with the upcoming Ethereum merge and the transition to ETH 2.0 with sharding at the base chain, we expect to see ETH L1 dominance fall as alternative L1s continue to grow and L2 solutions cannibalize Ethereum’s own growth.

DAOs (Decentralized Autonomous Organizations)

While there are still many outstanding questions on the exact role DAOs will play, it is clear that they are here to stay and are building the future of distributed work. Most of the DAO tooling is still primitive, non-integrated, and in many cases off-chain, and nothing exemplifies the current issues even more than extreme voter apathy across the board. We at AscendEX are keeping our eyes peeled as to what is still to come to improve the user experience for interacting and participating in a DAO, especially when it comes to innovative D2D (DAO-to DAO) business models.

Entrenched Incumbents

In a short period of time, we have gone from mainstream institutions and businesses disregarding crypto to many of them embracing an entirely new paradigm. Incumbents across technology, finance, gaming, music, and more have started to make strategic efforts as part of the shift to Web 3.0. Developments such as Facebook’s rebrand to Meta, fintech, and traditional finance’s increasing crypto-rail integration, and gaming companies recognizing the significance of play to earn, all indicate that these businesses have begun their respective land grabs. Each of these companies will be dealing with their own sets of the innovator’s dilemma, as they begin to disrupt some of their own business models. The question remains, which will successfully make the transition to the crypto economy, and which will lose out to crypto native upstarts?

Year in Review: AscendEX Highlights

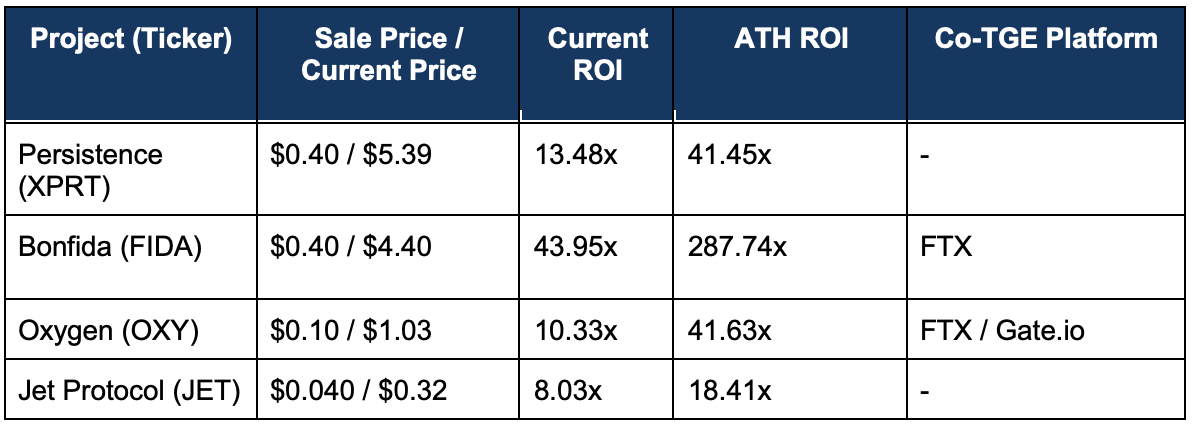

Known for our top performing IEOs, AscendEX has continued to deliver on its mission to provide platform users early access to some of the most exciting projects across many ecosystems in the space, with the primary auctions and listings of projects such as Persistence, Bonfida, Oxygen, Jet Protocol, and more. As highlighted below, by conducting their IEOs with AscendEX, these projects were able to gain access to favorable liquidity conditions and thereby achieve efficient price discovery, extending AscendEX’s track record of selecting highly performing projects. Historically, across all IEOs, AscendEX has an avg. Current ROI of 832% and an avg. ATH ROI of 4714%.

Note: Current ROI was calculated on 12/17/2021 using mark to market.

AscendEX Earn

One of the most powerful tools that a centralized exchange can provide for the projects it lists are direct integrations to their underlying infrastructure (staking, lending / borrowing, etc.). This boosts the project’s fundamentals and network value, which ultimately improves the project’s overall health and state of maturity. In the summer of 2021 AscendEX launched an all-encompassing earning portal for retail users to gain access to the high yield opportunities in DeFi, all without needing to interact directly with the Web 3.0 protocols themselves. With AscendEX Earn, the complexity of DeFi is abstracted away, enabling users comfortable with centralized exchanges to seamlessly benefit from the exciting and often complicated innovations taking place in DeFi. As the rise of DEX trading venues continued throughout the year, AscendEX is excited to have built a seamless integration to DEX infrastructure. This allows us to offer AscendEX users one unified access point to the broader DeFi ecosystem and the novel projects within.

AscendEX Milestones

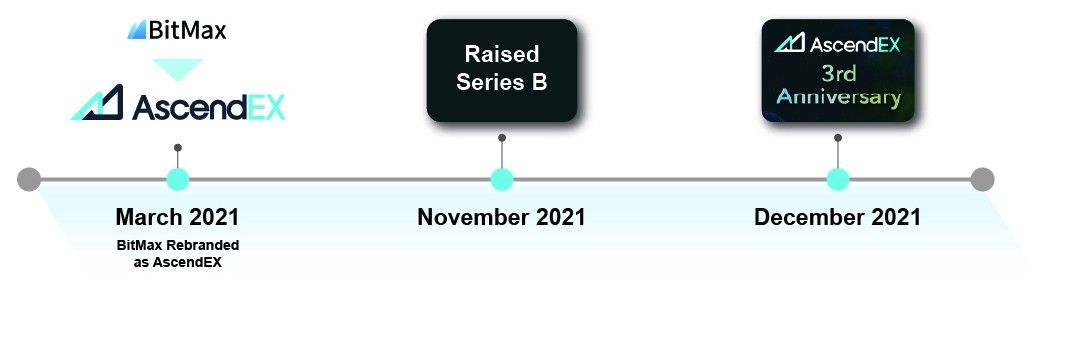

In addition to exciting IEOs, primary listings, and product launches, over the past year AscendEX has hit a number of critical milestones as the exchange continues to scale and mature as a platform. In March, the platform was rebranded to AscendEX from BitMax, signifying the company’s aspirational ambitions and goal of building a leading global digital asset platform, bridging CeFi and DeFi, as well as Eastern and Western geographies. By November, AscendEX announced the closing of its $50m Series B fundraise, led by Polychain Capital and Hack VC, with additional participation from Jump Capital and Alameda Research, and soon after celebrated the platform’s 3 year anniversary.

As AscendEX continues to grow into a more comprehensive financial service provider to the digital asset ecosystem, it’s crucial to support as many initiatives as we can. This is taking shape with activities that we’re really excited about, including Polkadot Slot Auction support, layer-two network integrations, and more IEOs!

Note on the recent AscendEX Security breach:

In the wake of AscendEX’s hot wallet security breach (see here), we have been working endlessly to do right by our customers, mitigate losses, and return to business as usual as soon as possible. We are proud of the fact that our priority was to reimburse customers 100% for any of their losses, that trading, staking, yield farming never went down, and that we were able to reopen deposits and withdrawals safely. There are both good times and bad times in crypto, and we believe that an organization’s true color shows when times are hard. We are grateful for the outpour of support we’ve seen from our close partners and clients who jumped at the first moment to help out. We see the incident as an opportunity to lead by example to support our fundamental values of transparency, resilience, and integrity. Nevertheless, we are heading into 2022 excited about the prospect of further bolstering user trust as we continue our next phase of growth as a global platform.