Margin refers to the initial fund required when users open a futures position. AscendEX Futures employs the Multi-asset Collateral mechanism, allowing users to use one or multiple cryptocurrencies as margin while trading multiple futures underlying assets such as BTCUSDT, ETHUSDT, and more. AscendEX Futures also utilizes a robust risk management system and margin mode to support high-leverage trading.

I. Collateral Mode: Multi-asset Collateral

AscendEX Futures supports up to 100 different cryptocurrencies, including USDT, BTC, ETH, ADA, DOT, TRX, LINK, and more, as margin assets. For specific details, please refer to the Collateral Info section. The Multi-asset Collateral mechanism calculates the total margin value by considering the total value of all assets transferred into your Futures account, denominated in USDT.

Collateral = Assets x Index price x Discount factor

Notes:

1. Index Price: Index prices on AscendEX Futures are calculated based on the average of the spot prices from exchanges such as Binance, HTX, OKX, Poloniex, and AscendEX, excluding the highest and lowest prices. This helps mitigate the impact of a single platform failure on the market. For more details, please refer to the Index Price & Mark Price section.

2. Discount Factor: The factor when assets are used as collateral. The discount factors for different trading pairs can be found in the Collateral Info.

3. AscendEX supports using assets engaged in the Earn products as collateral, allowing users to transfer assets (cryptocurrency-S) from their Earn account to their Futures account to participate in futures trading while earning returns. The transfer can be completed on the Transfer page by selecting "From Earn" to "To Futures," choosing the target cryptocurrency and entering the transfer amount, and clicking the Transfer button for instant processing.

II. Margin Type: Initial Margin and Maintenance Margin

1. Initial Margin

The initial margin is the minimum amount of margin required to open a position. The required amount of initial margin depends on the current position value and leverage. Higher leverages require a smaller initial margin.

Initial margin = Position value x Initial margin rate

Initial margin rate = 1 / Leverage x 100%

Example:

If a trader opens a long futures position of BTCUSDT at the price of $10,000 with 50X leverage, the initial margin rate would be 1/50 = 2%, and the initial margin amount would be (1 x 10,000) x 2% = 200 USDT.

2. Maintenance Margin

The maintenance margin is the minimum amount of margin required to maintain the current position. If the collateral balance falls below or equal to the maintenance margin amount, the position will be liquidated.

Maintenance margin = Position value x Maintenance margin rate

Notes:

1) The maintenance margin rate is determined by the margin level based on the position value and can be found in the Margin Requirements section.

2) Collateral balance = Total collateral + Unrealized PnL.

3) Margin ratio = Maintenance margin / Collateral balance. When the margin ratio reaches 100%, the position will be liquidated.

Example:

If a trader holds a BTCUSDT futures position worth 50,000 USDT, the maintenance margin for the position would be 50,000 x 0.4% = 200 USDT. To avoid forced liquidation, the collateral balance in trader's account should not fall below 200 USDT.

III. Margin Mode: Cross Margin and Isolated Margin

AscendEX Futures currently supports two margin modes: cross margin and isolated margin.

In cross margin mode, the collateral is shared among all positions. This enables efficient utilization of assets in the futures account, preventing rapid liquidation of positions and improving the ability to withstand potential losses in the portfolio.

In isolated margin mode, the collateral for each position is independent and does not affect other positions. This mode provides more flexibility. When one position triggers liquidation, it does not impact other positions.

For more details, please refer to Margin Mode: Cross/Isolated Margin.

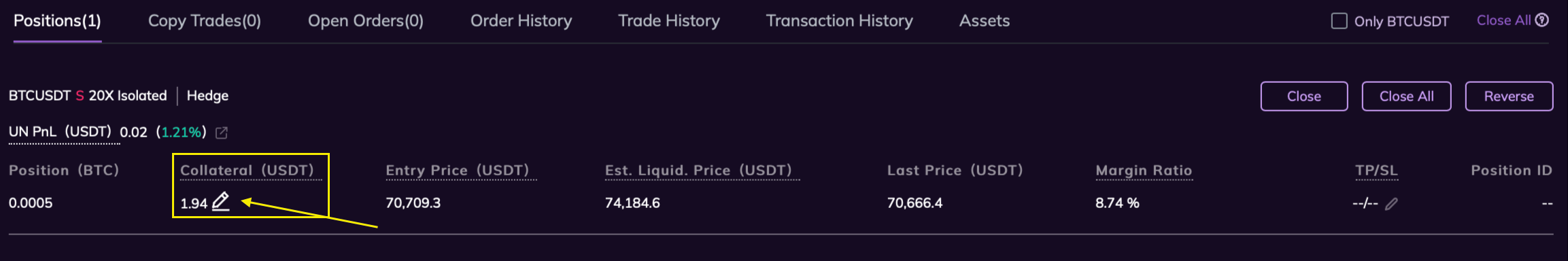

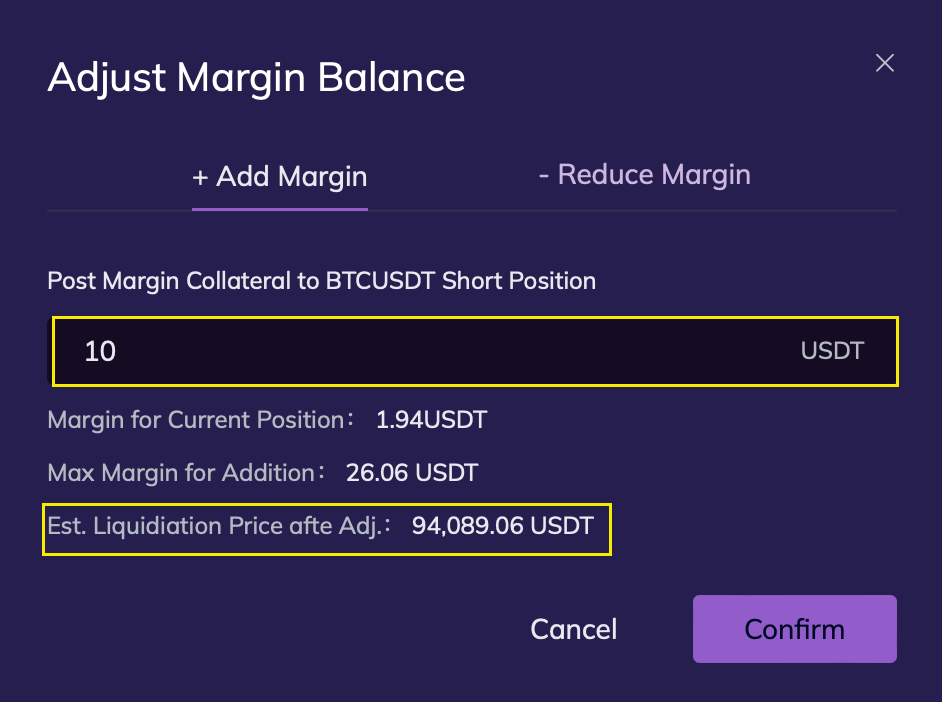

IV: Adjusting Margin on Your Position

AscendEX Futures only supports position margin adjustment under isolated margin mode. Users can manually increase or decrease the collateral of specific positions to adjust the estimated liquidation price and manage risks.

Notes:

1. Margin adjustment does not affect leverage.

2. After adjusting the margin, the liquidation price will be recalculated based on the new position collateral. When reducing the margin, the position collateral should not fall below the maintenance margin required to hold the position.

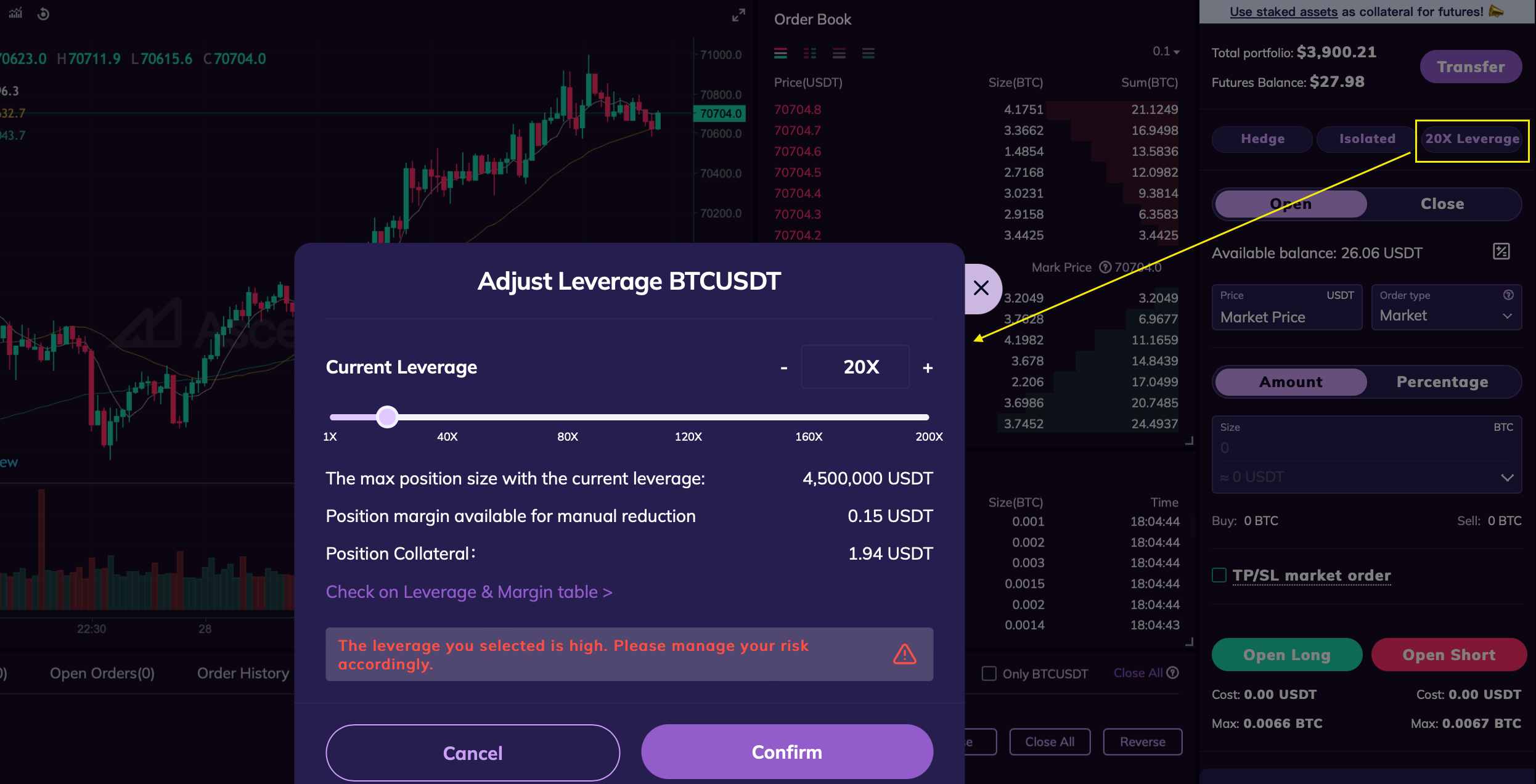

V. Relationship between Margin and Leverage

Leverage in futures trading is closely related to the margin system. Higher leverages require lower margin, amplifying the trading power while increasing potential profits and risks.

AscendEX Futures supports leverage adjustment for positions:

- When a trader increases leverage for a position, the system will allow the adjustment if the new leverage is lower than the available maximum leverage based on the margin requirement of the current position value. After the adjustment, the collateral required for the position will be decreased.

- When a user decreases leverage, the required collateral will be increased. The system will allow the adjustment if there is sufficient balance in the account.

Notes:

1. Adjusting leverage does not directly affect the PnL. When the leverage of a position is adjusted, the collateral amount will change accordingly, however, the position size will remain the same.

2. In cross margin mode, adjusting leverage will cause an increase or decrease in the collateral used by the position. In isolated margin mode, adjusting the leverage will cause a change in the collateral used by the position without affecting the overall collateral in the isolated margin account.

3. AscendEX Futures supports leverages ranging from 1X to 200X for different futures assets. The specific leverage limits can be found in the Margin Requirements section. Traders can change leverage for their positions and no additional fees are charged for leverage adjustment.