HELP CENTER

Only 5 Minutes to Understand Easy Options

Publish on 2023-06-05

1. What is Easy Options?

Easy Options is a simplified form of options trading designed to provide traders with an easy way to invest in the price fluctuations of cryptocurrencies. Traders can choose from a variety of options contracts with different underlying assets, strike prices, and settlement periods. The user-friendly nature of Easy Options makes options trading accessible to both beginners and experienced traders.

2. How does Easy Options work?

Easy Options is based on various cryptocurrencies, such as Bitcoin. The price of each Easy Options order is generated based on the current market price of the underlying asset, the exercise price (also known as the strike price) of the options, and the remaining time to expiration. As the price of the underlying asset fluctuates, the price of the options also changes. Traders need to anticipate the price movement of the underlying asset to make informed buying and selling decisions.

The settlement of Easy Options is based on the price fluctuations of the underlying asset during the settlement period. For long-term options (e.g., 24-hour options), the settlement period starts 30 minutes before the beginning of each trading day (8:00 AM UTC), specifically from 7:30 AM to 8:00 AM UTC. For short-term options (e.g., 30-minute options), the settlement occurs at the expiration time of the options.

3. What is the category of Easy Options?

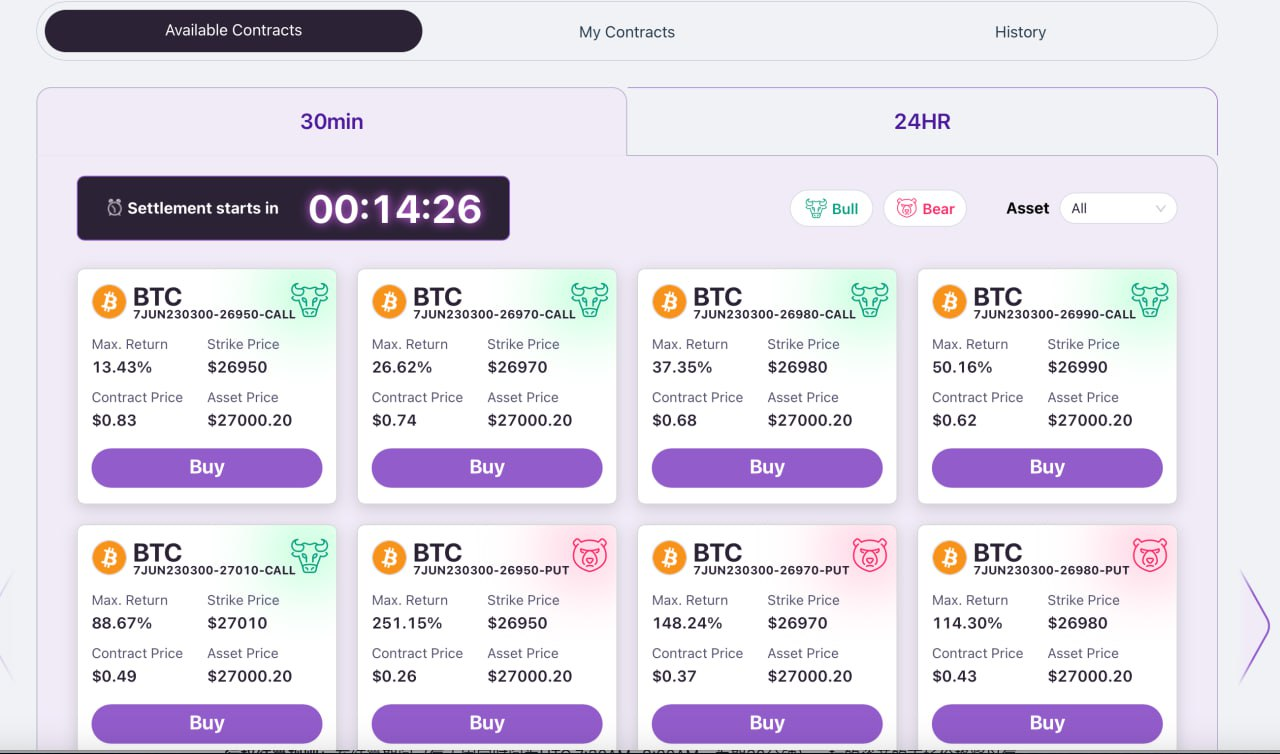

Easy Options offer two types of options based on their duration and expiration date.

Intraday Options: It is also known as short-term options. These are options with a lifespan of less than 24 hours, providing traders with opportunities to capitalize on short-term market volatility. Options such as 30-minute options offer a faster-paced trading experience, allowing traders to open and close positions within shorter time frames.

Exercise and Settlement Rules: For intraday options like 30-minute options, there is no separate settlement period. Instead, the outcome of the options is determined based on the price of the underlying asset at the expiration time. At the expiration time, the settlement price is determined by comparing the exercise price of the options with the price of the underlying asset at the expiration time. If the price of the underlying asset is higher than the strike price of a call option or lower than the strike price of a put option, the option is considered in the money and will be settled accordingly, resulting in profits for the trader. Conversely, if the price of the underlying asset is unfavorable relative to the strike price, the options will expire out of the money, resulting in no profits for the trader.

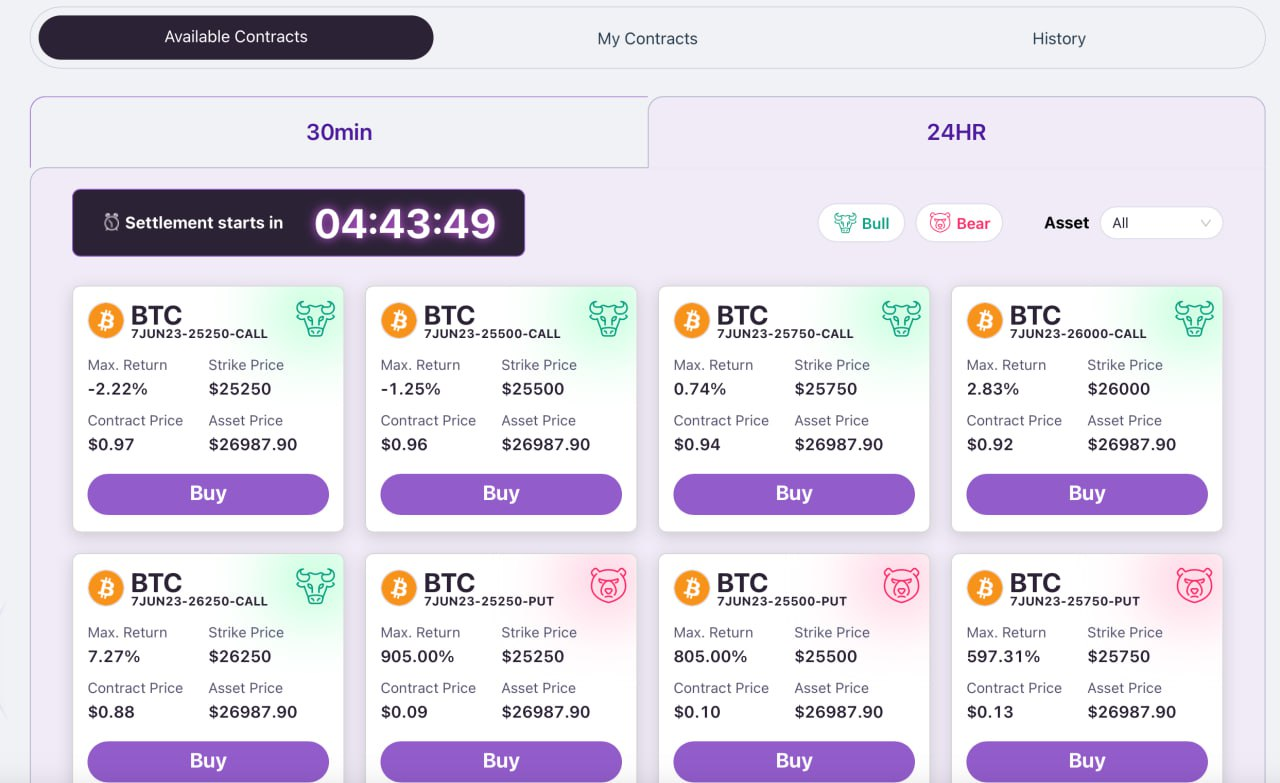

24-Hour Options: These options provide traders with a longer expiration period of 24 hours, allowing them to hold positions across multiple trading sessions. This gives traders more time to analyze market trends and make informed decisions.

Exercise and Settlement Rules: During the settlement period (a fixed timeframe of 30 minutes from 7:30 AM to 8:00 AM UTC), the market price of the underlying asset is compared to the exercise price of the options contract every minute for a total of 30 comparisons. If the market price of the underlying asset is higher than the exercise price for a specific minute in the case of a call option or lower than the exercise price for a put option, it is considered a hit. At the end of the 30-minute period, the settlement price is calculated based on the number of hits (also known as the number of options exercises) using the following formula:

Settlement Price = Number of Hits / 30 x $1

Example 1:

Let's say you purchased 100 call options contracts of ABC at an options price of $0.5, with an exercise price of $10, for a total investment of $50. During the 30-minute settlement period, the closing price of ABC was higher than the exercise price in 22 out of 30 one-minute intervals. As a result, your options hit 22 times, resulting in a settlement of (22 / 30 x $1) x 100 = $73.3 (excluding fees and commissions), a profit of $23.3 ($73.3 - $50), and a return rate of 46.6% ($23.3 / $50).

Example 2:

Assume you purchased 100 put options contracts of XYZ at an options price of $0.75, with an exercise price of $50, for a total investment of $75. During the 30-minute settlement period, the closing price of XYZ was $48 (below $50) for 18 out of 30 one-minute intervals. Therefore, your options hit 18 times, resulting in a settlement of (18 / 30 x $1) x 100 = $60 (excluding fees and commissions), and a loss of $15.

I. How to Trade Easy Options?

1. Fund Your Options Account

Before you start trading Easy Options, you need to deposit funds into your options account. Navigate to the Wallet page and transfer USDT to your options account.

2. Choose Your Favorite Options Contract

Selecting the appropriate Easy Options contract is a crucial part of successful trading. When choosing options, consider the current price of the underlying asset and market conditions. If you anticipate the price of the underlying asset to rise above the exercise price, choose a call option. If you expect the price to fall below the exercise price, choose a put option.

3. Trade Easy Options

Confirm the order size of options you wish to purchase. You can sell options at any time before the settlement period begins. There are no fees for buying options, but trading fees and commissions apply to selling and settling options. Selling and settlement of fixed transaction fees for each options contract is $0.05. Additionally, if the trade is profitable, a commission of 5% will be charged on the profit. No commission is charged if the trade results in a loss.

4. Settlement and Profits

Real-time settlement takes place for a period of 30 minutes starting from 7:30 AM UTC each day. The longer the market favors your side, the higher the exercise price. The settlement amount is calculated based on the number of your hits.

5. Receiving Profits

After the settlement period ends, the profits will be automatically credited to your balance in USDT, based on the number of your hits. You can check your records and performance in the Purchased Options section.

II. Advantages of Easy Options

1. No Specialized Knowledge Required

Easy Options only require users to have an expectation of the future price of the underlying asset, making it accessible to anyone.

2. Potential for High Returns and Limited Risks

The minimum cost to purchase an Easy Options is $0.05, with a maximum return of $1, which means there is a possibility of achieving a 20-fold return. At the same time, the maximum risk for users is limited to the amount they initially invested, which is less than 1 USDT per order.

3. Short Settlement Period and Fair Settlement Price

We currently offer two types of options: long-term options (24h) and short-term options (30-min), which means options will be settled every day or every half hour.

Moreover, for our 24h options, instead of comparing the exercise price with the market price only at the last moment before expiration, we lock in a 30-minute period prior to the options’ expiration for the settlement process. We compare the market price with the exercise price 30 times to determine a fair settlement price, avoiding any negative impact from short-term market volatility.