AscendEX officially provides services for leveraged tokens, an emerging crypto derivative product. Seven leveraged tokens are currently available on the platform, with a total of 20 trading pairs. Users can directly engage in leveraged token trading without having to put up any additional collateral and without facing any risk of liquidation. They can easily multiply their returns through several clicks. Please read the following article to learn more details regarding AscendEX’s leveraged tokens.

1. What Are Leveraged Tokens?

A leveraged exchange-traded fund (ETF) is designed to track the movements of an underlying asset by using financial derivative instruments, so as to amplify the returns of the underlying asset. Like traditional ETFs, a leveraged ETF tracks the price action of a designated underlying asset. However, traditional ETFs completely “duplicate” the price movements of underlying assets, while leveraged tokens come with leverage to multiply the returns of underlying assets. Please note that leveraged tokens seek to magnify the returns of an underlying index at a ratio for a single day, not a time period.

To put it simply, leveraged tokens are regular EFTs with leverage. For example, BTC leveraged 3x means if the BTC price increases by 1%, the BTC leveraged 3x long (BTC3L) would increase by 3% (3*1%). Likewise, if the BTC price declines 1%, the BTC leveraged 3x short (BTC3S) would fall by 3% (3*1%).

2. What Are AscendEX Leveraged Tokens?

AscendEX leveraged tokens are a brand-new type of digital asset derivative product launched by the platform. It’s designed to track the daily price movements of an underlying asset and help investors increase their earnings by magnifying the returns of the underlying asset.

For example, if you buy a BTC leveraged 3x long (BTC3L) and the BTC price increases by 10%, the net value of the BTC3L you hold will surge 30%. Likewise, the net value of a BTC leveraged 3x short (BTC3S) will fall by 30%.

Main features of AscendEX Leveraged tokens:

1. A Perpetual derivative without a due or settlement date, with a trading experience similar to spot trading.

2. Users can engage in leveraged tokens trading to earn greater returns without having to put up any additional collateral.

3. No liquidation risks for leveraged tokens due to the rebalance mechanism.

3. Overview of AscendEX Leveraged Tokens

1. AscendEX leveraged tokens can be upwardly leveraged or inversed. For example, taking BTC as an underlying asset, users can select to trade BTC3L, BTC5L, BTC3S, or BTC5S.

2. AscendEX leveraged tokens support 3x and 5x leverage. Leverage varies depending on different leveraged tokens and a few leveraged tokens are only available with 3x leverage. Please navigate to the AscendEX Leveraged Token Trading page to learn more details before trading.

3. The naming rule for AscendEX leveraged tokens: underlying asset + leverage + long/short. Take BTC3L as an example, BTC refers to the underlying asset or underlying token; 3 means 3x leverage; L stands for long, or being long the market.

4. Please see the seven major leveraged tokens now available on AscendEX, with a total of 20 trading pairs below:

Token | Trading Pairs | Leverage | Pair Details |

|---|---|---|---|

| BTC | 4 | 3, 5 | BTC3S/USDT, BTC3L/USDT, BTC5S/USDT, BTC5L/USDT |

| ETH | 4 | 3, 5 | ETH3S/USDT, ETH3L/USDT, ETH5S/USDT, ETH5L/USDT |

| XRP | 4 | 3, 5 | XRP3S/USDT, XRP3L/USDT, XRP5S/USDT, XRP5L/USDT |

| TRX | 4 | 3, 5 | TRX3S/USDT, TRX3L/USDT, TRX5S/USDT, TRX5L/USDT |

| GMT | 2 | 3 | GMT3S/USDT, GMT3L/USDT |

| APE | 2 | 3 | APE3S/USDT, APE3L/USDT |

Please note: L means long, S means short, 3/5 means 3x or 5x leverage.

More trading pairs will be made available soon. Please navigate to the AscendEX Leveraged Token Trading page to get more details about trading pairs.

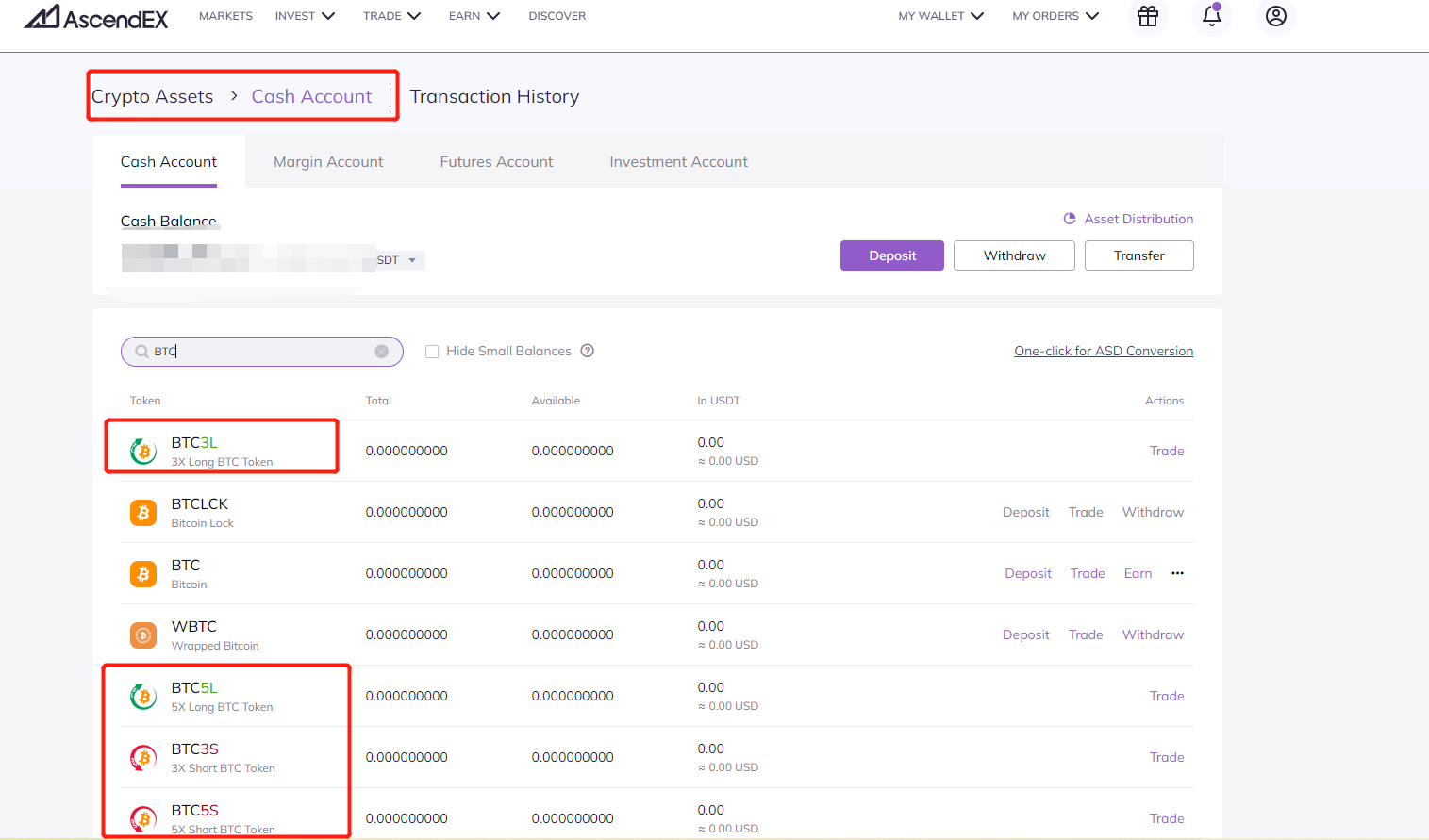

5. AscendEX Leveraged Tokens are calculated in USDT, with their trading mechanism similar to spot trading. Users can directly trade leveraged tokens using USDT and they can check their trading assets in their cash wallets.

6. A Leveraged token is essentially a type of financial derivative, rather than a crypto spot trading. Therefore, leveraged tokens are only supported for trading, not for deposit, withdrawal, transfer, investment, conversion and other functions.

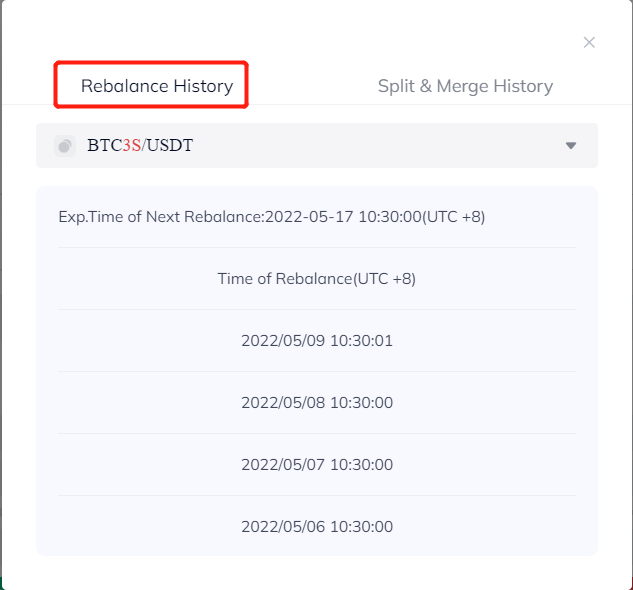

7. The platform rebalances leveraged token positions daily at 2:30 a.m. UTC in order to ensure a fixed multiplier between the daily returns of a leveraged token and the spot returns of the corresponding underlying asset. If the market fluctuates sharply and the price swing range of the underlying asset exceeds the given range set at the previous rebalance point, the platform will make a temporary rebalance to reduce trading risks. The temporary rebalance only targets the products that suffer losses due to market fluctuations. AscendEX will announce position rebalance history on a daily basis and users can visit the Rebalance page to check details.

8. The price at which users buy a leveraged toekn is not the underlying asset price, but a fair value of the leveraged token in the markets, namely net asset value. As market fluctuations may lead to a potential premium in net asset value, users should be aware that the price at which they buy an asset does not dramatically deviate from the net asset value of the underlying asset so as to avoid losses.

9. Formulas for calculating the net asset value of AscendEX leveraged tokens:

leveraged 3x tokens : Net asset value = the net asset value at the previous rebalance point*[ 1±3*(the latest price of the underlying asset-the price of the underlying asset at the previous rebalance point)/ the price of the underlying asset at the previous rebalance point *100%]

leveraged 5x tokens : Net asset value = the net asset value at the previous rebalance point*[ 1±5*(the latest price of the underlying asset-the price of the underlying asset at the previous rebalance point)/ the price of the underlying asset at the previous rebalance point *100%]

Please note: the net asset value at the previous rebalance point refers to the net asset value of the position after the last rebalance of positions.

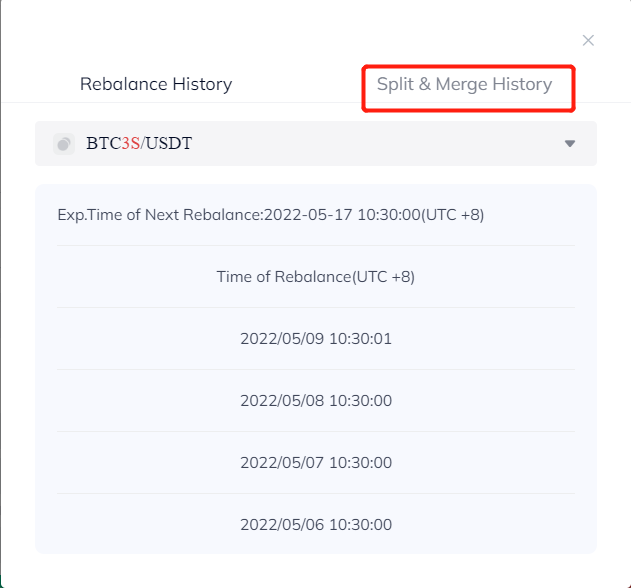

10. The initial net value of all leveraged tokens on the platform is 1. To optimize the user experience, if the net asset value of a leveraged token after a rebalance is lower than a given range, the platform will perform merge operation for the leveraged token. Likewise, if the net asset value of a leveraged token after a rebalance is greater than a given range, the platform will perform split operation for the leveraged token. AscendEX will regularly announce the net asset value merge/split history. Users can visit the Split and Merge page to check details.

11. Trading leveraged tokens involves two types of fees: transaction fees while trading leveraged tokens and management fees for maintaining leveraged token positions. Please see below for details:

(1) Transaction fees:

Leveraged token trading is similar to spot trading. Just like the spot trading fee standards, the fee of trading leveraged tokens is Maker: 0.2000%/Taker: 0.2000%.

(2) Management fee:

AscendEX will charge users the management fee for holding leveraged tokens on a daily basis at 12:00 a.m., 8:00 a.m. and 4:00 p.m. UTC, respectively. The fee will be automatically deducted from the net asset value of the leveraged tokens and no extra payment is required from users. No management fees are required if no holdings happen at the three above timelines. Management fees vary depending on the leverage of a leveraged token.

leveraged 5x tokens: daily holding management fee:0.5%, charge once every 8 hours, 3 times a day, and 0.167% per time.[AS1]

leveraged 3x tokens: daily holding management fee:0.3%, charge once every 8 hours, 3 times a day, and 0.1% per time[AS2] .

4. How to Trade Leveraged Tokens on AscendEX?

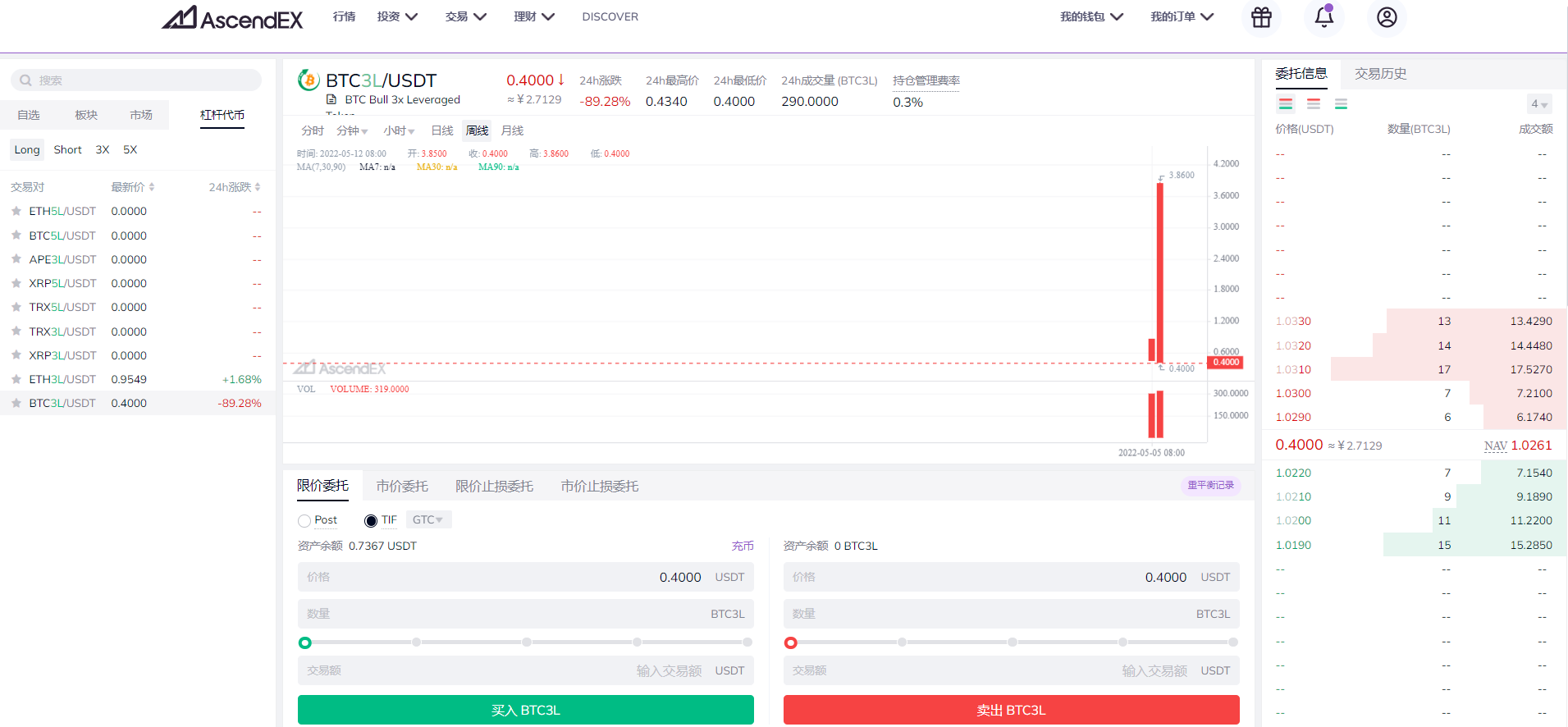

1. Trade

Like spot trading, users can directly trade leveraged tokens on the spot markets.

2. Account assets

3. Rebalance History

4. Merge/Split History

5. Advantages of AscendEX Leveraged Tokens?

1. No additional collateral and easy operations. Leveraged token trading is similar to spot trading and users can trade leveraged tokens on spot trading UX, without having to put up collateral. Users can trade leveraged tokens on AscendEX’s spot market with just a few clicks.

2. Rebalance mechanism reduces trading risks. Different from traditional perpetual contracts where wrong trend predictions may lead to the liquidation of positions, leveraged tokens capitalize on the rebalance mechanism to accordingly adjust fund contract positions amid market fluctuations, ensuring that the leveraged token maintains a fixed leverage ratio the user agreed upon for a certain period of time, which could help users to reduce trading risks and avoid liquidation of their positions.

Please click FAQs on AscendEX Leveraged Tokens for more details.