HELP CENTER

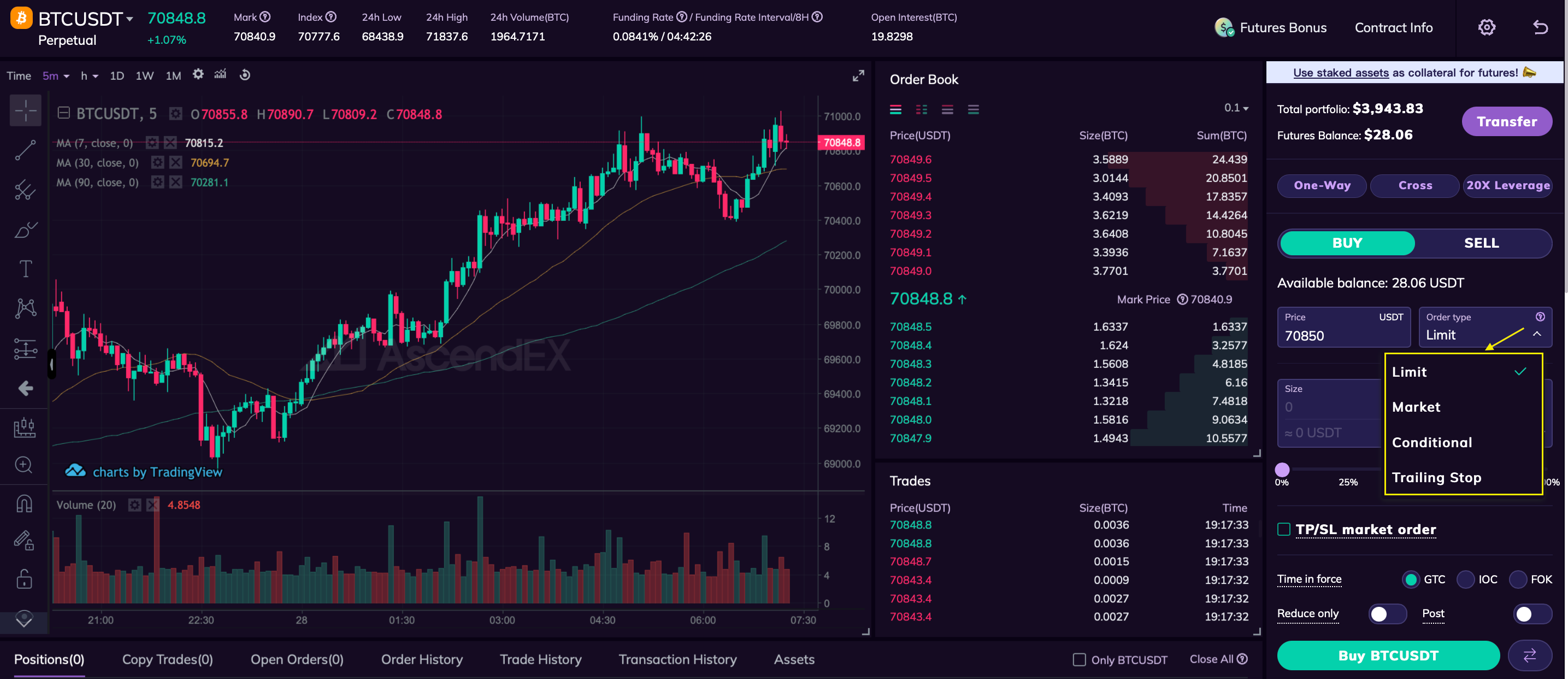

Futures Order Type: Limit Order/Market Order/Conditional Order/Trailing Stop

Publish on 2021-09-16

AscendEX currently supports four types of orders for futures trading: limit order, market order, conditional order, and trailing stop.

I. Limit Order

A limit order is an order type that allows users to buy or sell at a specified price. When the market price reaches the specified limit price, the system will execute the trade at the limit price or the best price within the limit price range.

Limit orders are suitable when you want to buy at a specific price lower than the current market price or sell at a specific price higher than the current market price. They can be used when you are not in a hurry to execute the trade but want to lock in profits or limit losses.

When placing a limit order, you can choose from three order execution strategies:

1. GTC (Good till Canceled): The order remains active until it is fully filled or canceled. (This is the default option in futures trading on AscendEX.)

2. IOC (Immediate or Cancel): The order is immediately filled either partially or entirely, and any unfilled portion will be canceled.

3. FOK (Fill or Kill): The order must be filled in its entirety immediately, or it will be canceled.

For more details, please refer to the Time in Force (TIF) options: GTC/FOK/IOC.

When placing a limit order, you can also choose from the following options:

1. Post Only: The order will always be a maker order when executed. It will appear as a posted order in the order book. If the order can be matched with the existing market depth, the order will be canceled.

2. Reduce Only: This order type is only available in the One-Way mode. A reduce-only order is an order that only allows decreasing the position size. It ensures that the position will not increase, avoiding unnecessary positions made by the order originally intended for taking profit due to market reversals. For more details, please refer to Reduce Only.

II. Market Order

A market order is an order type that is executed immediately at the current best market price. When placing a market order, you can choose to buy or sell based on the Amount or Percentage.

Notes:

1. Market orders are executed quickly at the current best market price, which may result in slippage, causing the actual execution price to differ from the expected price.

2. Market orders of different futures symbols may have various limits on the maximum amount per order. Please check the margin requirements for each futures trading pair.

3. The execution method for closing positions with market orders is Immediate or OTC (IOO). When using a market order to close a position, the system automatically places an IOO order. The order is first matched with the existing orders in the order book. If the order is too large to be filled immediately, it will be handled by BLP.

III. Conditional Order

A conditional order allows users to set trigger prices, order prices, and order amount in advance. When the latest price or mark price reaches the trigger condition, a take-profit or stop-loss order will be automatically placed, and the order is based on the preset order price and amount.

Parameters:

1. Trigger Type: Last price (the last traded price in the market) or mark price (a fair mark price).

2. Trigger Price: When the last price (or mark price) reaches the preset trigger price, the order will be placed.

3. Order Price: The price at which the conditional order will be executed after being triggered.

4. Order Size: The amount of the conditional order to be placed after being triggered.

Important notes: Conditional orders may not be successfully triggered and placed due to limits on price, order size, and position size, insufficient collateral, network issues, system issues, or significant market fluctuations.

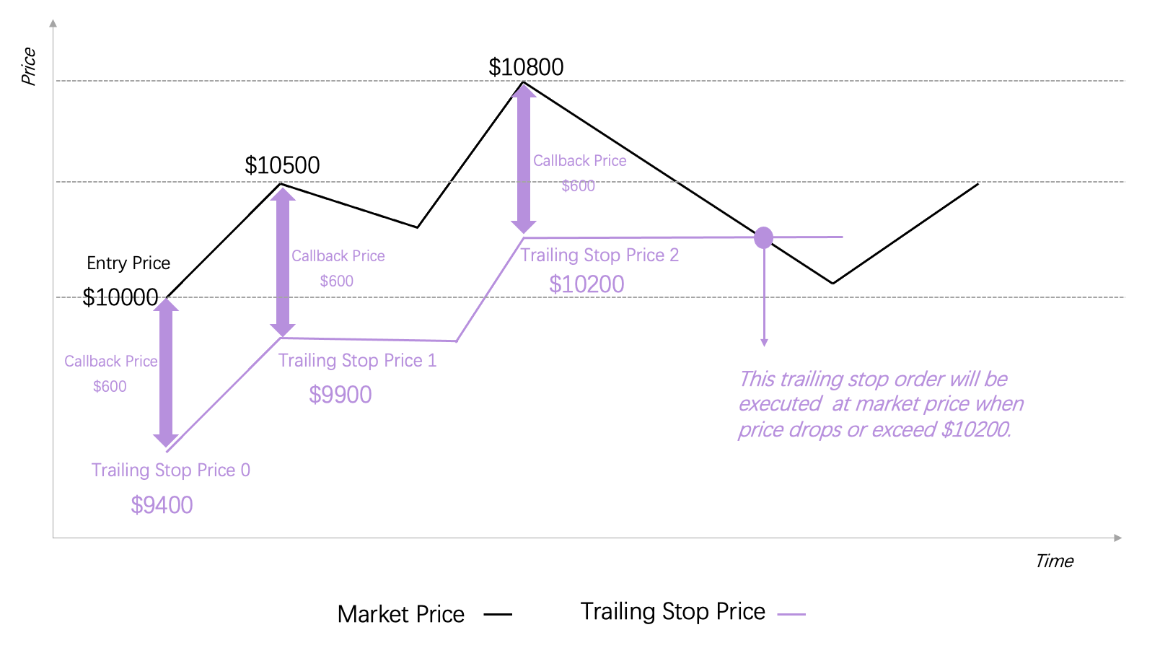

IV. Trailing Stop

A trailing stop is a type of stop-loss order. Unlike a regular stop-loss market order, when placing a trailing stop order, you do not provide a trigger price but set a trailing amount (i.e., a price distance).

Parameters:

1. Trailing Amount: It represents the fixed distance between the stop-loss trigger price and the current market price, whose value is always positive. For a buy order, the trailing amount represents the price increase required to trigger the stop-loss order, i.e., the stop-loss trigger price = market price + trailing amount. For a sell order, the trailing amount represents the price decrease required to trigger the stop-loss order, i.e., the stop-loss trigger price = market price - trailing amount.

2. Trigger Price: It is determined by the trailing amount and will change with the market price. For a buy order, the trigger price will decrease as the market price drops but will remain locked when the price rises. For a sell order, the trigger price will increase as the market price climbs, but it will remain locked when the price dips. When the market price reaches the locked trigger price, the system will automatically place a market order.

Example:

Let's use an example to illustrate the trailing stop order (buy stop) to buy BTC with a trailing amount of $100, assuming the current BTC market price is $10,000. The initial trigger price of the order would be $10,000 + $100 = $10,100. The order will then follow your profitable direction, which is downward.

1. If the BTC price increases by $100 or more, reaching or exceeding $10,100, the order will be triggered. In this case, a market order will be executed, closing the short position.

2. If the BTC price drops, the order’s trigger price will fall accordingly. For instance, if the BTC price is down to $9,500, the trigger price will decrease from the initial $10,100 to $9,600. As long as the price continues to decline, the trigger price will follow the downward movement, always maintaining a trailing amount of $100 and not triggering the order. However, if the market price starts to rise after reaching $9,500, the trigger price will be locked at $9,600. As soon as the market price rebounds and reaches $9,600, a market order will be executed, closing the short position.

It's important to note that during a downward market movement, no matter how many price rebounds occur, as long as the increase does not exceed the preset trailing amount of $100, the trailing stop order will remain active and not be triggered.