HELP CENTER

New Take-Profit/Stop-Loss Instructions for Futures Trading

Publish on 2020-07-01

Dear BitMax.io Users,

To further enhance futures trading experience, BitMax.io has implemented new take-profit/stop-loss instructions for Limit Order and Market Order. The original Stop Limit & Stop Market orders were respectively renamed as Conditional Limit Order & Conditional Market Order. Details are as follows:

New Take-Profit/Stop-Loss Instructions for Limit/Market Order

With the two instructions, users can set Take Profit (TP) or Stop Loss (SL) to place TP/SL market orders. When the market price reaches the pre-set TP/SL prices, TP/SL orders will be filled at the market price.

How to Set Take-Profit and Stop-Loss

Users can add TP/SL instructions to their orders or positions in the following two ways:

- Add TP/SL when placing new orders

- Add TP/SL when holding positions

Add TP/SL When Placing New Orders

Steps:

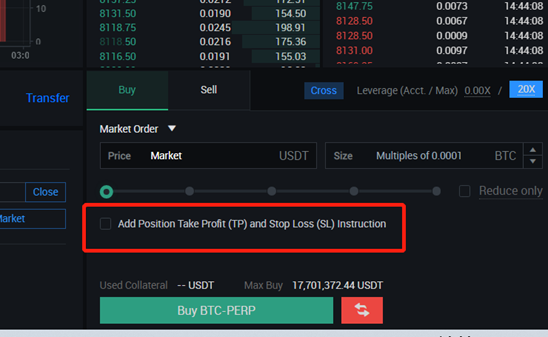

1. Visit Futures Trading page, choose Limit Order/Market Order;

2. Enter an order price (not applicable for Market Order) and order size;

3. Check the "Add Position Take Profit (TP) and Stop Loss (SL) Instruction" box;

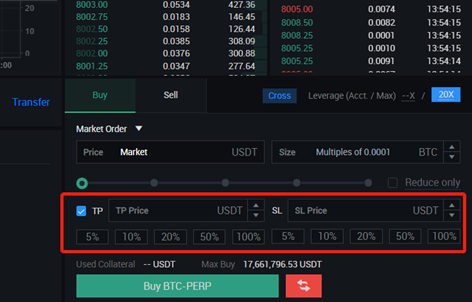

4. Enter a take-profit price (TP price) and/or stop-loss price (SL price); or you can directly click on the percentage% below and the system will automatically calculate a TP/SL price to fill the fields.

Add TP/SL When Holding Positions

Users can also add or modify TP/SL when holding positions.

Steps:

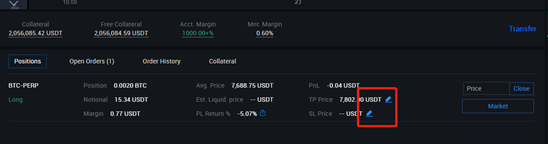

- Go to the Positions tab;

- Click on the blue edit icon;

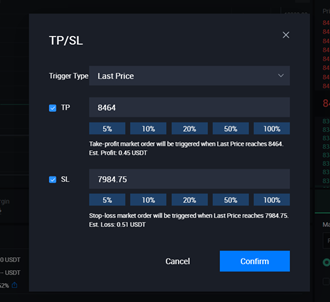

- Set Trigger Type & TP and/or SL price(s) in the pop-up window.

Notes:

1. a) For users who already have open positions with Take Profit/Stop Loss instructions added, the option will no longer be available for new orders.

b) For users without any open positions, they can place multiple orders with Take Profit/Stop Loss instructions added; if one of the orders is filled and displayed under the Positions tab, the remaining orders will be executed later per initial setup of Take-Profit/Stop-Loss instructions.

2. If a user sets a take-profit order & a stop-loss order at the same time and one order is triggered, then the other one will be automatically canceled.

3. The take-profit price of a buy order must be higher than the current Mark Price/Last Price; The take-profit price of a sell order must be lower than the current Mark Price/Last Price.

4. The stop-loss price of a buy order must be lower than the current Mark Price/Last Price; The stop-loss price of a sell order must be higher than the current Mark Price/Last Price.

5. Reduce Only and IOO instructions are implemented by default for take-profit/stop-loss orders, in order to avoid opening unintended opposite positions.

6. The original Stop Limit and Stop Market orders were renamed as Conditional Limit Order and Conditional Market Order. Users can choose Last Price/Mark Price as the trigger price (stop) and place limit/market orders. When the market price reaches the pre-set trigger price, the system will automatically place the order per the pre-set price and size.

Click here for Take-Profit/Stop-Loss Guide

We truly appreciate your continued support.

The BitMax.io Team

July 1, 2020

————————————————————————————————

English Telegram Group:https://t.me/BitMaxioEnglishOfficial

India Telegram Group:https://t.me/BitMaxIndiaOfficial

Russian Telegram Group: https://t.me/BitMaxioRussian

Korean Telegram Group:https://t.me/BitMaxioBTMXioKoreanCommunity

Turkish Telegram Group: https://t.me/BitMaxBTMXTurkishOfficial

Vietnamese Telegram Group: https://t.me/BitMaxVietnameseOfficial

Italian Telegram Group: http://t.me/BitMaxOfficialItalianCommunity

Japanese Telegram Group: https://t.me/BitMaxioJapaneseOfficial

Arabic Telegram Group:https://t.me/BitMaxioArabicOfficial

Spanish Telegram Group:https://t.me/bitmax_spain

Twitter:https://twitter.com/BitMax_Official

YouTube:https://www.youtube.com/channel/UCqd6zelqTz03nkl2A3KHKtw

facebook:https://www.facebook.com/BitMaxio-107405837611170