YARDIM MERKEZİ

Margin Mode: Cross/Isolated Margin

2021-12-03'da yayınlayın

AscendEX Futures currently supports two margin modes: Cross margin and Isolated margin.

I. Cross Margin Mode

1. What is cross margin mode?

In cross margin mode, the collateral is shared among all positions. This enables efficient utilization of assets in the futures account, preventing rapid liquidation of positions and improving the ability to withstand potential losses in the portfolio.

Note: In cross margin mode, all assets in the Futures account are used as collateral and liquidation of the positions will result in the loss of all the assets.

2. Calculation of Margin in Cross Margin Mode:

Position margin = Position size * Mark price / Leverage

3. Advantages/Risks of Cross Margin Mode

✓ Lower risk of forced liquidation.

✓ Lower initial margin requirement, allowing for flexible position adjustments.

✗ In cases of high market volatility, there is a higher probability of depleting all assets in the Futures account.

II. Isolated Margin Mode

1. What is isolated margin mode?

In isolated margin mode, the collateral for each position is independent and does not affect other positions. This mode provides more flexibility. When one position triggers liquidation, it does not impact other positions.

2. Calculation of Margin in Isolated Margin Mode:

Position margin = Position size * Mark price / Leverage

3. Advantages/Risks of Isolated Margin Mode

✓ When positions are liquidated, only the pre-set position margin (and additional margin added) is lost, and it does not deplete the entire available balance of the Futures account.

✗ When all margin is utilized, traders cannot open new positions.

✗ In cases of high price volatility and high leverage adopted, positions under isolated margin mode are more prone to forced liquidation and losses.

Example:

Suppose you have 30,000 USDT in your Futures account, and you open a long position for 1 BTC with 5X leverage at the price of $57,000 with the balance. If the BTC price continues to rise to $60,000, and you want to increase your long position by 1 BTC:

In isolated margin mode: Since all available assets in your account are already utilized, and considering a leverage of 5X, there are no available funds to open a new position. If you still want to open a new position, you can increase the leverage for more effective asset usage by manually reducing the collateral used by existing positions to free up some for the new position.

In cross margin mode: The initial margin occupies only a portion of the available balance, leaving sufficient collateral in the account to open new positions.

III. Switching Margin Modes

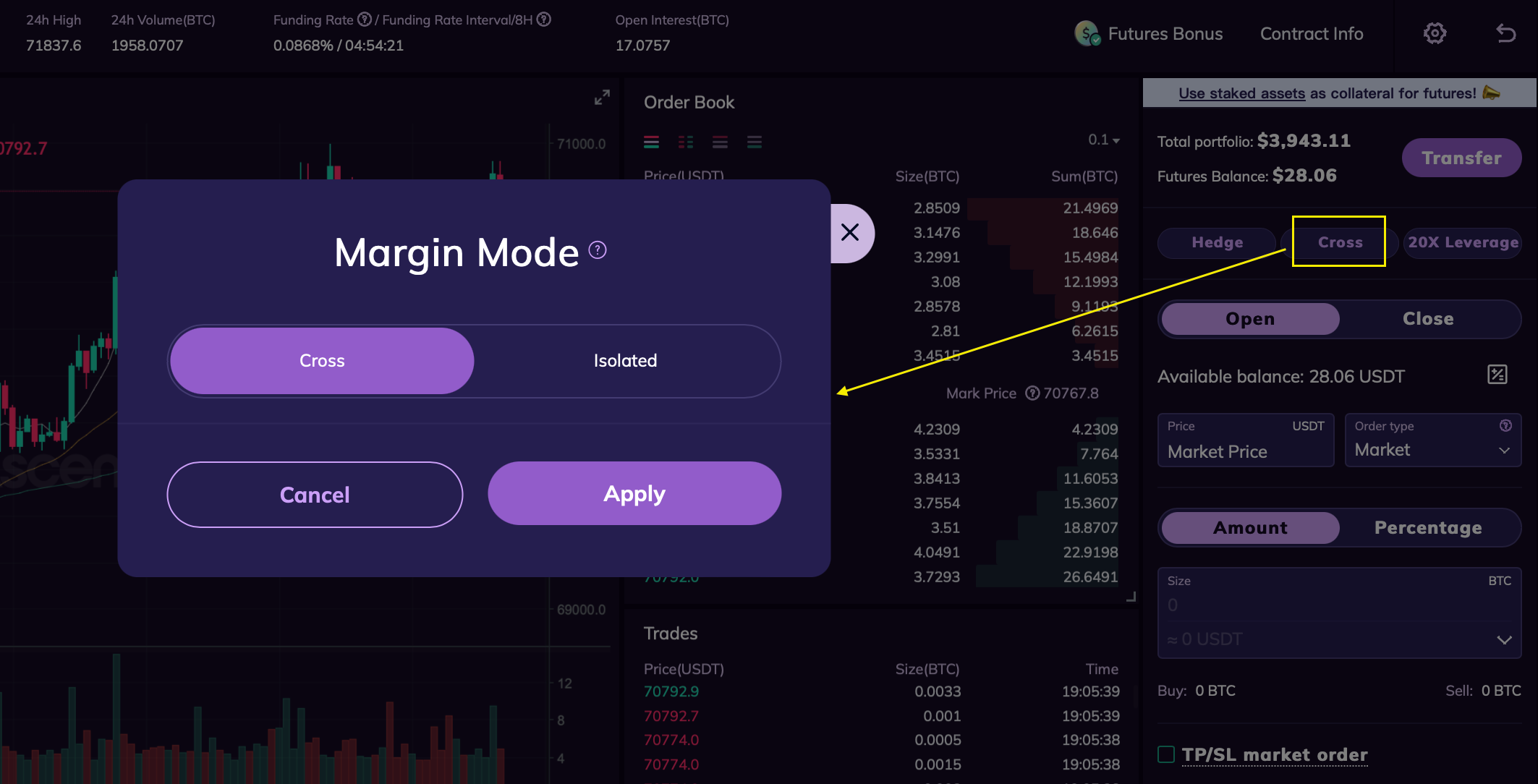

For PC clients:

Click Cross in the trading area on the right side of the Futures page, select the desired margin mode, and click Apply.

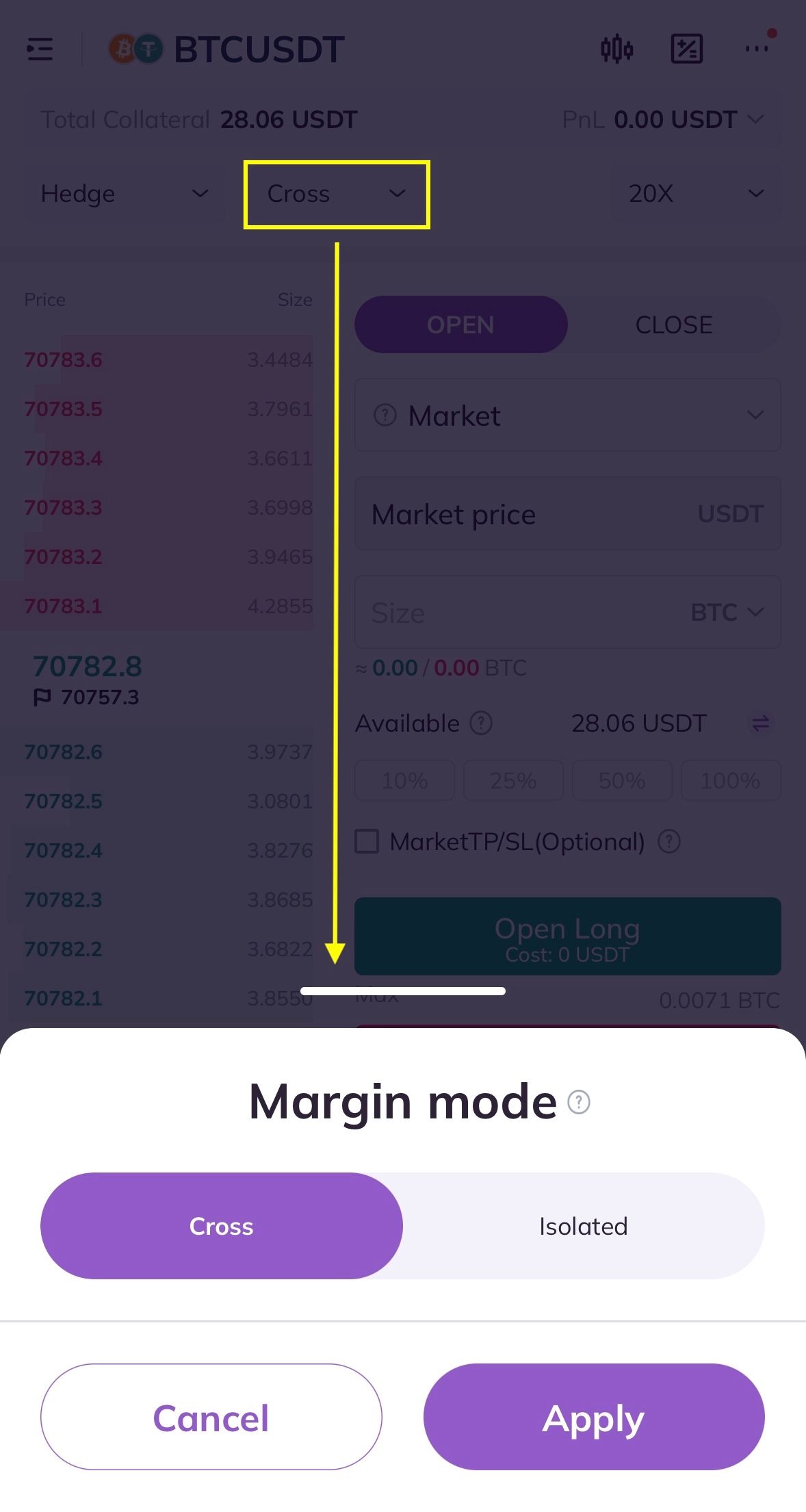

For app clients:

Tap Cross on the top navigation bar of the Futures page, select the desired margin mode, and tap Apply.

IV. Special Notes on Margin Modes and Position Modes

1. The cross margin mode supports three position modes: One-Way, Hedge, and Multi-Position; The isolated margin mode supports only One-Way and Hedge.

2. The One-Way position mode allows the switch between cross margin and isolated margin modes for positions; The Hedge position mode does not support switching between cross margin and isolated margin modes for positions or pending orders; The Multi-Position mode only supports the cross margin mode.