YARDIM MERKEZİ

Take Profit and Stop Loss (TP/SL)

2021-06-03'da yayınlayın

Take Profit (TP) and Stop Loss (SL) are strategy orders used for closing futures positions to manage risks. Setting a take-profit (TP) and stop-loss (SL) order can help you lock in profits and control losses during market fluctuations. AscendEX Futures currently supports TP/SL orders at market price and TP orders at a limit price.

I. What is TP/SL?

The TP/SL feature allows you to preset take-profit and stop-loss prices for your position. When the last price or mark price reaches your trigger price (i.e. TP or SL price), a market or limit order will be automatically placed to quickly get the position executed.

Parameters:

1. Trigger Types: Last Price, Mark Price

2. Order Types: Market, Limit

3. Trigger Prices: The preset TP and SL prices

Notes:

1. During significant market volatility with sharp price increases or decreases, the actual execution price of the order may differ from the displayed price on the platform.

2. Intense market price fluctuations may result in TP/SL orders not being executed or only partially filled. It's important to understand the functionality and use them with caution. AscendEX will not be responsible for any losses caused by market price fluctuations.

II. How to set TP/SL?

AscendEX Futures offers two methods for placing TP/SL orders: Order TP/SL settings and position TP/SL settings.

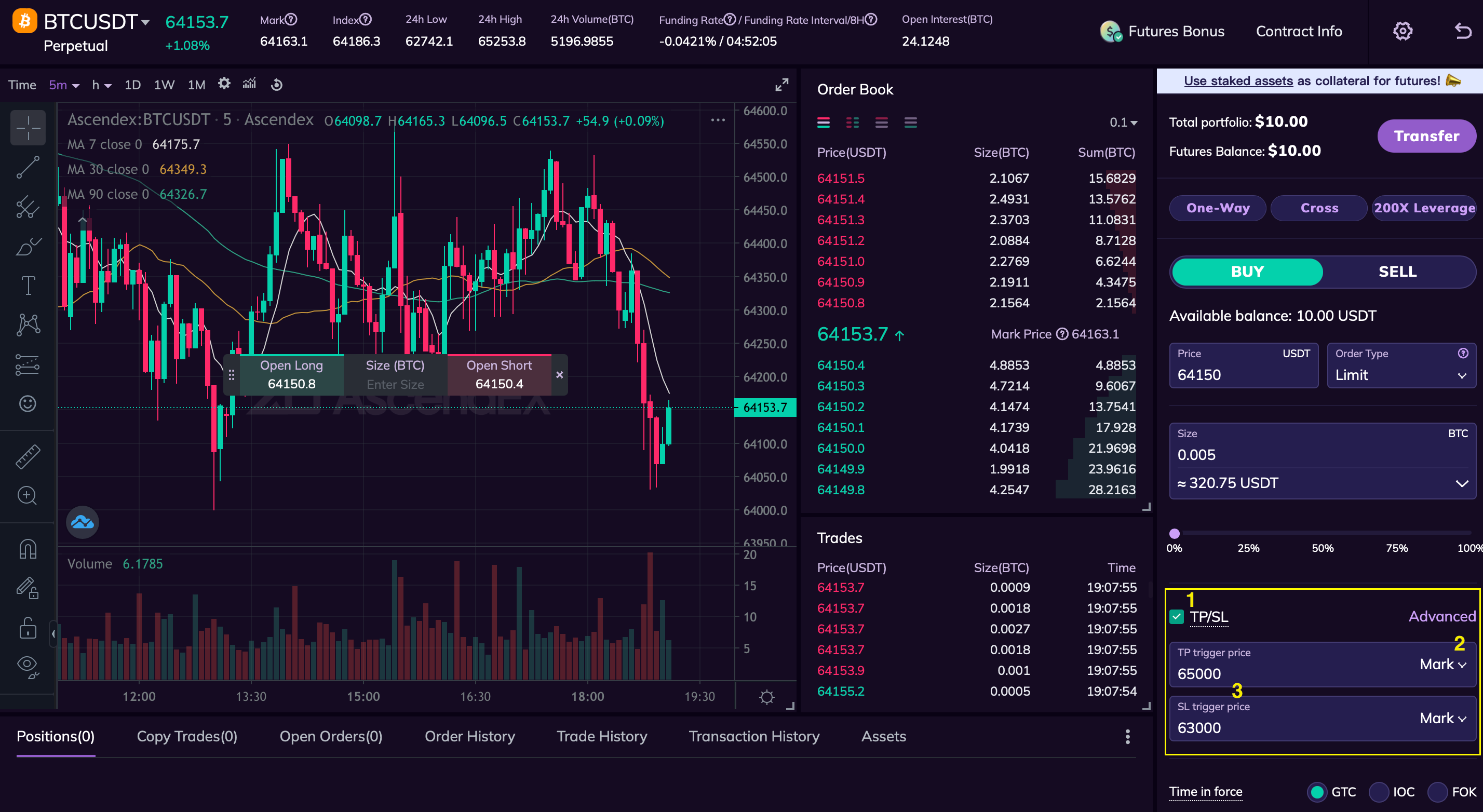

1. Order TP/SL Settings

Order TP/SL refers to the take-profit and stop-loss settings you apply to your current order when opening a position. Here is how you can set TP/SL for an order:

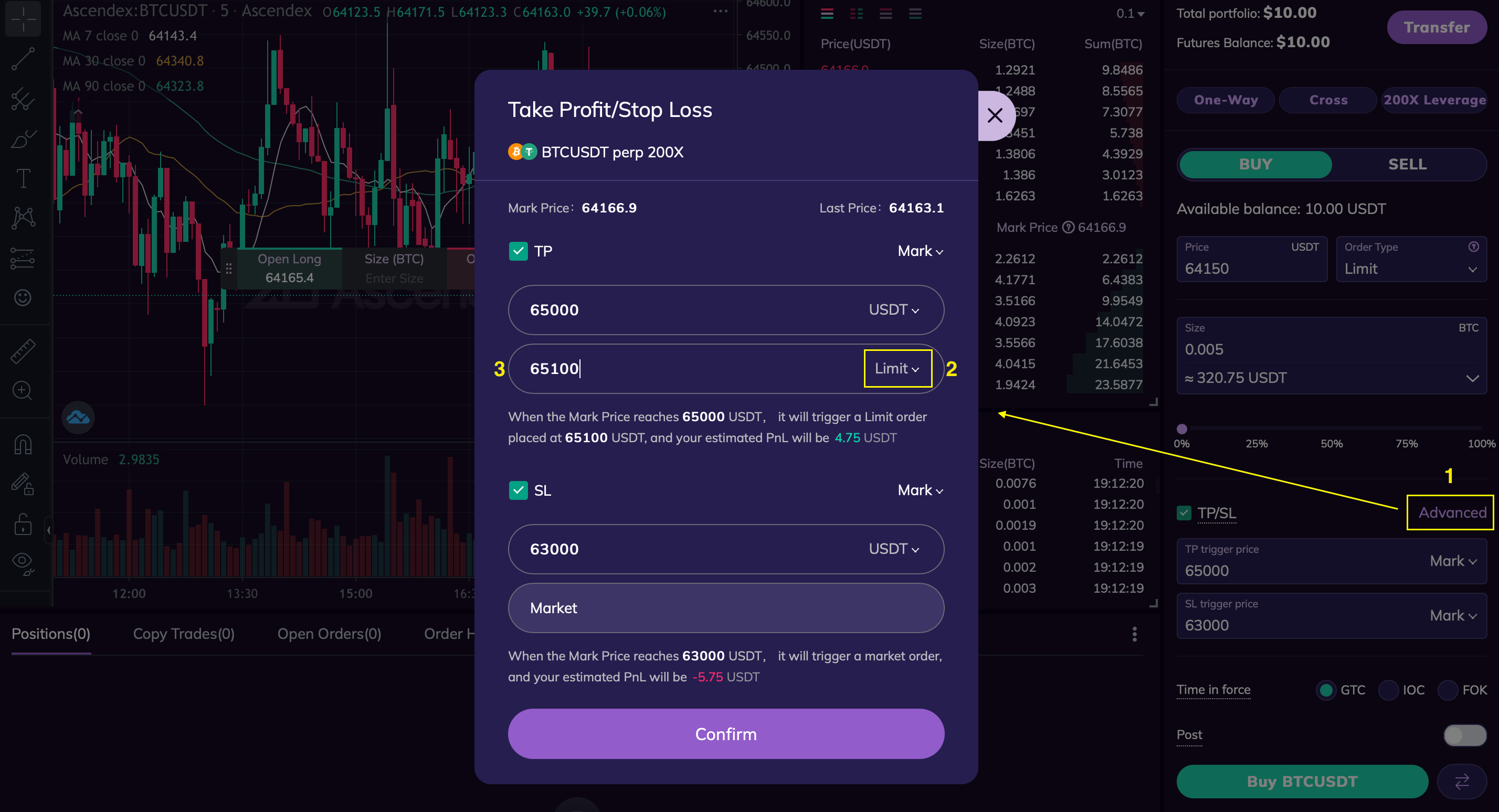

Step 1: When placing a limit or market order, check the TP/SL option and choose the trigger of either Mark or Last. Enter a TP or SL price, and then click Buy/Long or Sell/Short to place the order.

Note: The system defaults to TP/SL at market price, which means that when the last price or mark price reaches the trigger price, your order will be executed as a market price. To set a TP order at a limit price, you can go to the Advanced feature.

Step 2: After the order is executed, you can modify the TP/SL instructions. Click the modification icon on the position panel to enter the TP/SL settings page. You can manually enter new prices for TP/SL and click confirm to complete the modification.

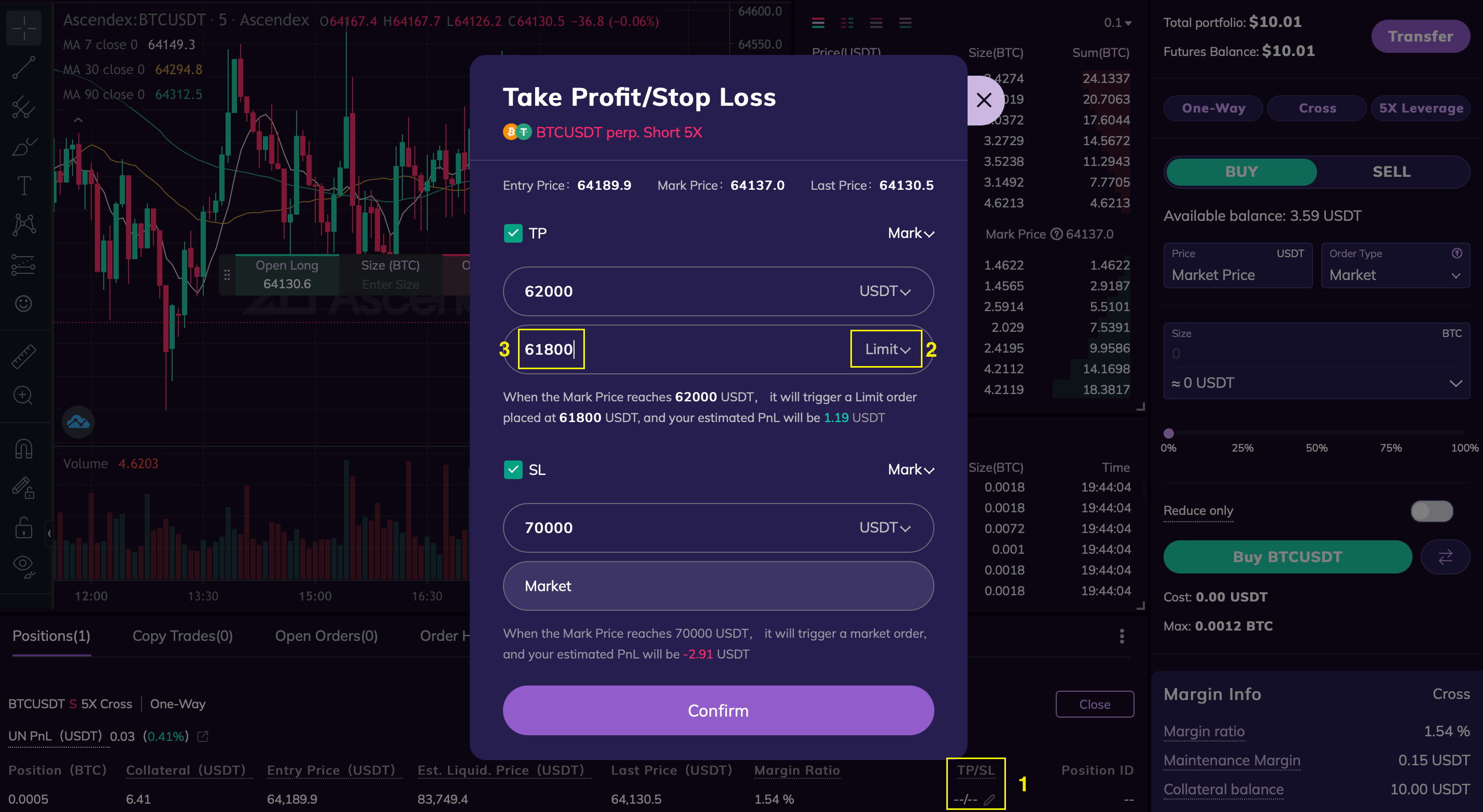

2. Position TP/SL Settings

Position TP/SL refers to adding take-profit or stop-loss instructions to your open position on the position panel after the order is executed. Here is how you can set TP/SL for a position:

Step 1: Click the modification icon on the position panel to enter the TP/SL settings page.

Step 2: You can manually enter new prices for TP/SL and choose whether it applies to the entire position or a partial position. Click confirm to complete the settings.

III. How to cancel TP/SL?

In the Positions panel, click TP/SL and then you will see a prompt for the TP/SL settings. Uncheck the Take Profit or Stop Loss options to cancel or modify the TP/SL settings.

IV. Notes

1. TP/SL instructions can be set for futures order types of both limit and market.

2. TP orders support both market and limit orders, while SL orders only support market orders.

3. For long positions, the TP price should be higher than the last price, and the SL price should be lower than the last price.

4. For short positions, the TP price should be lower than the last price, and the SL price should be higher than the last price.

5. When setting a TP order at a limit price, the TP order price should be higher than the trigger price for long positions, and lower than the trigger price for short positions.

6. In the One-Way or Hedge mode, if you have one position with TP/SL set, you won't be able to set TP/SL when placing another order of the same symbol. In the Multi-Position mode, you can set TP/SL for each new position of the same symbol.

7. If both TP and SL orders are set simultaneously, when either order is triggered, the other order will be automatically canceled.

8. TP/SL orders include Reduce Only and IOO instructions by default to prevent unintended reverse positions.